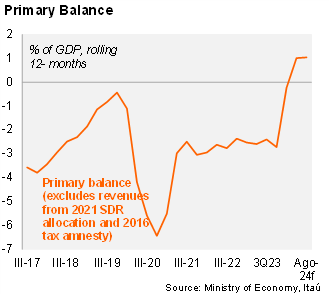

Argentina’s treasury ran yet another primary surplus in August, reaching ARS 899.7 billion, significantly above the deficit of ARS 37.0 billion posted one year earlier. The nominal fiscal balance also posted a surplus of ARS 3.5 billion (after marking a deficit in July), well below the deficit of ARS 384.5 billion of August 2023. As a result, the primary balance during the first eight months of the year reached a surplus of 1.5% of GDP, while the nominal balance stood at +0.4% of GDP. Based on these figures, we estimate a consolidated nominal deficit of around 1.4% of GDP year to date (including net interest payments from the central bank), narrowing from 6.4% in the same period of 2023.

Real tax revenues fell in the quarter ended in August, mainly affected by the cyclical contraction in economic activity. Tax collection fell by 8.0% yoy in real terms in the period, after dropping by 3.9% in 2Q24. Total real revenues decreased by 11.2% yoy in the period (-5.6% in 2Q24).

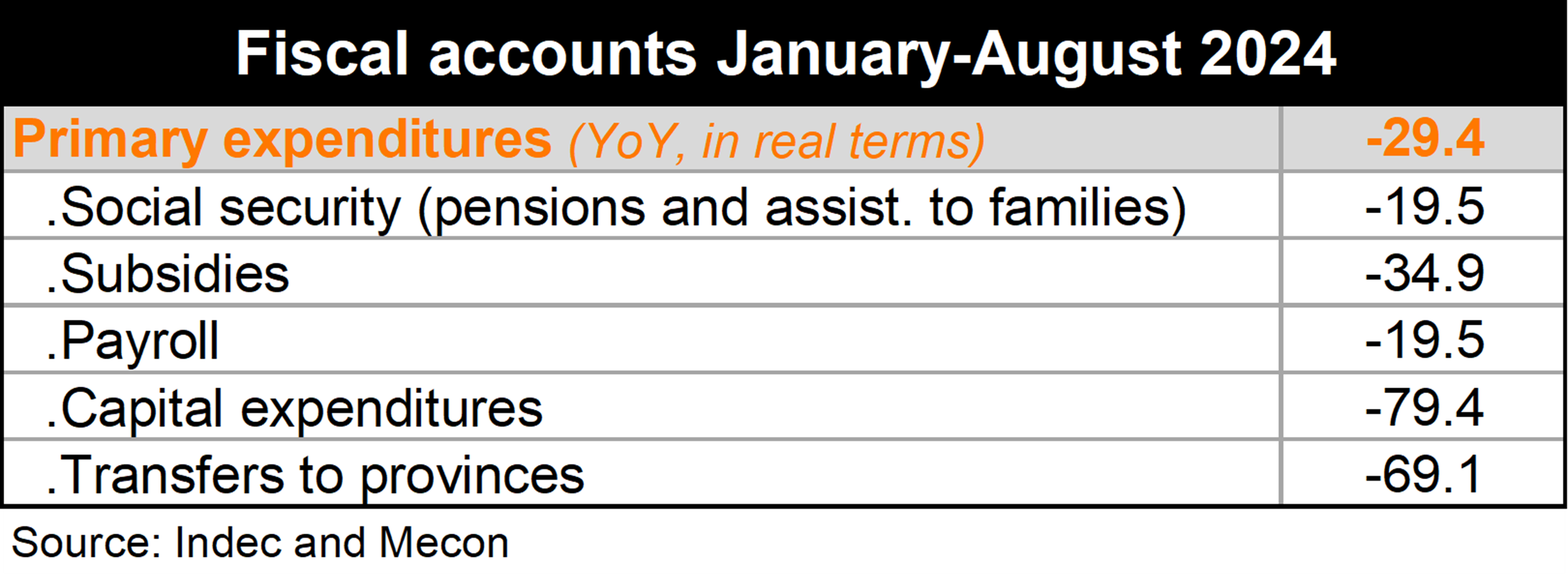

Strict control on expenditures continues. Primary expenditures declined by 27.5% yoy in real terms in the period, compared with a 30.0% yoy drop in 2Q24. Pension payments were down 14.5% yoy (-19.8% in 2Q24), while payrolls decreased by 20.8% yoy (-17.2% in 2Q24), both affected by the sharp acceleration of year-over-year inflation. Capital expenditures were down sharply by 75.1% yoy (-76.7% in 2Q24) due to the freeze on public works. Energy subsidies fell by 41.0% yoy, compared with a drop of 44.2% in 2Q24, while transfers to provinces plunged by 62.1% yoy.

Our take: Our primary fiscal balance forecast stands at +1.0% of GDP, significantly above the deficit of 2.7% of GDP in 2023 due to the ongoing fiscal adjustment. Next year's budget, recently presented by the administration, proposes an ambitious balanced budget.