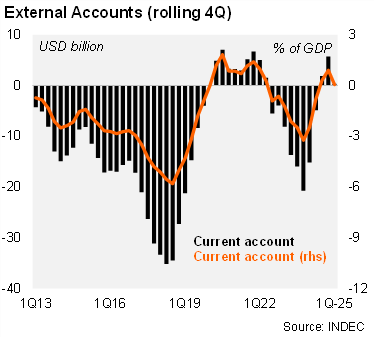

The current account showed a deficit of USD 5.2 billion in 1Q25, down from a surplus of USD 0.2 billion in the same quarter of 2024, led by a small goods surplus and a large services deficit.

A small goods trade surplus in 1Q25. Exports increased by 7.1% YoY while imports rose by 34.2% YoY. Thus, the goods trade balance printed at a surplus of USD 2.1 billion in the period, down from a surplus of USD 5.1 billion in the same quarter of 2024. On the other hand, the service account deficit widened to USD 4.5 billion, from USD 1.4 billion one year earlier, due to a deterioration of the travel accounts amid a stronger ARS. The deficit for the income balance (net interest bill and dividend payments) narrowed to USD 3.3 billion, from a deficit of USD 4.1 billion in 1Q24.

International reserves decreased by USD 5.6 billion during 1Q25, mostly reflecting the above-mentioned current account deficit. External debt stood at USD 278 billion in 1Q25 (40.6% of GDP), down from USD 290 billion in 1Q24 (47.0% of GDP).

Our take: We forecast a current account deficit of 1.3% of GDP in 2025, down from a surplus of 1.0% of GDP in 2024, due to a higher net tourism expenditure abroad and shifts in domestic demand.