2025/11/25 | Diego Ciongo & Soledad Castagna

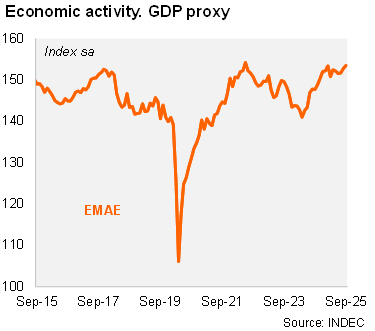

According to the EMAE (official monthly GDP proxy), economic activity unexpectedly rose by 0.5% MoM/SA in September, with substantial upward revisions to previous months. In particular, the EMAE expanded 0.7% MoM/SA in August (from +0.3% MoM/SA) on top of +0.1% MoM/SA in July (from -0.1% MoM/SA reported previously). Consequently, activity increased by 0.4% in 3Q25 after falling 0.1% QoQ/SA in 2Q25, clashing with expectations for the beginning of a technical recession in 3Q25. On an annual basis, activity jumped by 5.0% in September and by 3.5% in 3Q25 (+6.3% yoy in 2Q25). Thus, the statistical carryover for 2025 stood at 4.4%.

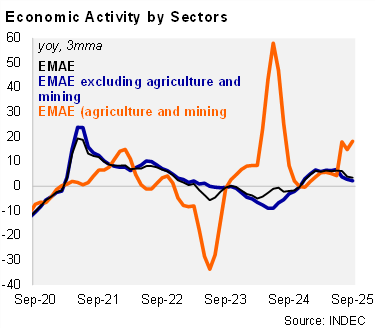

All sectors expanded on an annual basis in 3Q25, except manufacturing. Primary activities rose by 18.2% YoY during this period (compared to +4.3% YoY in 2Q25), while Services (including the commerce sector) expanded by 2.5% YoY (vs. 4.8% in 2Q25). Moreover, Construction rose by 0.8% YoY (from 10.6% YoY in 2Q25). On the other hand, manufacturing fell by 4.6% YoY (vs. a gain of 6.9% YoY in 2Q25).

Our take: The unusually large revision to activity data lead us to add an upside risk to our 2025 GDP growth forecast of 3.8%. The national accounts data for 3Q25 to be published on December 16 will be key to confirm the rebound of activity after a temporary sequential drop in 2Q25. The GDP proxy for October will be published on December 22.