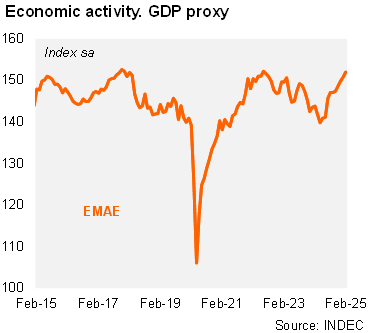

Activity rose sequentially in February, marking the fifth consecutive gain. According to the EMAE (official monthly GDP proxy), economic activity expanded by 0.8% MoM/SA in February, following a 0.6% MoM/SA growth in January. Thus, activity expanded by 2.1% QoQ/SA in February, after growing 1.8% QoQ/SA in the previous month. On an annual basis, activity rose by 5.7% in February and by 6.2% in the quarter ended in that month (+2.1% yoy in 4Q24). The annual figure was above the market forecast of 5.5%, as per the Bloomberg survey (median value).

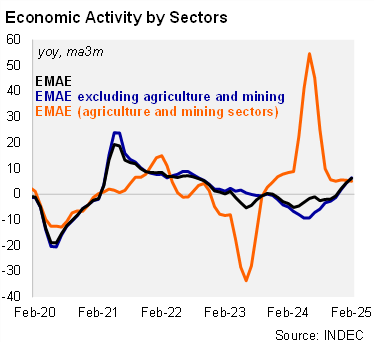

Most of the sectors rose on an annual basis. Primary activities rose by 5.0% YoY in the quarter ended in February (vs.+5.5% YoY in 4Q24), while manufacturing expanded by 6.2% YoY in the same period (vs. a gain of 0.7% YoY in 4Q24). Services (including the commerce sector) rose by 1.8% YoY in the period (vs. -0.4% in 4Q24), likely supported by the recovery of real wages. Construction fell by 0.5% YoY in the period (from -12.4% YoY in 4Q24), due to strict control of public works.

Our take: We forecast GDP growth at 4.5% in 2025, with upside risks due to high carry-over, despite the more challenging global scenario.