2025/08/07 | Andrés Pérez M., Diego Ciongo & Soledad Castagna

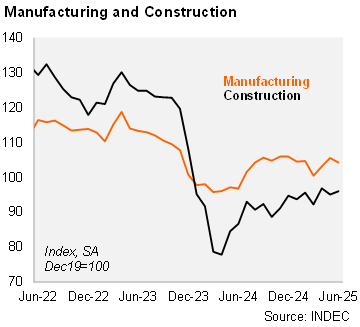

Manufacturing fell in June. The IPI manufacturing index fell by 1.2% mom/sa in June, after increasing by 2.3% mom/sa in May. However, industry output rose by 1.1% qoq/sa in 2Q25, following a 2.2% contraction in 1Q25. On an annual basis, manufacturing rose by 9.3% in June, and by 8.0% in 2Q25. All sectors grew in June on an annual basis. According to the INDEC survey, 23.3% of companies expect an annual increase in internal demand over the next three months, 35.8% expect a decline and 40.9% foresee no changes.

Construction rose in June. The construction index increased by 0.9% mom/sa in June, after decreased 1.8% mom/sa in the previous month. Moreover, construction rose remains increased 2.3% qoq/sa in 2Q25 (2.6% qoq/sa in 1Q25). Construction activity increased by 13.9% yoy in June and by 16.1% yoy in 2Q25. Employment in the sector increased by 4.1% relative to May 2024 (figures have a one-month lag). According to a qualitative survey, 69.3% of those involved in private construction expect no changes in activity levels over the next three months. Meanwhile, 9.9% expect an increase and 20.8% anticipate a decline. Among companies primarily engaged in publics work, 18.8% anticipate a decrease in activity levels during the next three months, while 64.5% expect no change and 16.7% expect an increase.

Our take: The mixed signals in the manufacturing and construction sectors in June were in line with our expectations. Our GDP growth forecast for 2025 is 5.2%, but now with downside risks.