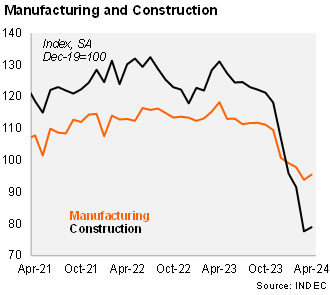

Manufacturing recovered in April. The IPI manufacturing index increased by 1.8% mom/sa in April, after six consecutive drops. Thus, industry output fell by 7.2% qoq/sa in April, following a 9.6% contraction in 1Q24. On an annual basis, manufacturing fell by 16.6% in April, and by 16.3% in the quarter ended in that month. All sectors posted year-over-year contractions in April, led by equipment, furniture and metal´s. According to the INDEC survey, only 10.0% of companies expect a year-over-year increase in internal demand over the next three months, 53.9% expect a decline and 36.1% foresee no changes.

Construction also rebounded in April. The construction index rose by 1.7% mom/sa in April, after eight consecutive drops. Thus, construction fell by 22.7% qoq/sa in April (-23.4% qoq/sa in 1Q24). Construction activity contracted by 37.2% yoy in April, and dropped 35.3% yoy in the quarter ended in that month. Employment in the sector contracted by 15.7% relative to March 2024 (figures have a one-month lag). According to a qualitative survey, 59.8% involved in private construction anticipate no change in activity levels over the next three months. Meanwhile, 32.7% anticipate a decrease, while only 7.5% expect an increase. Among companies primarily engaged in public works, 57.0% anticipate a decrease in activity levels during the May-July 2024 period, while 36.0% anticipate no change and 7.0% anticipate an increase. In our view, the fiscal consolidation program that includes the freeze of capital expenditures is behind the businessman's outlook for the construction sector.