2025/11/07 | Diego Ciongo & Soledad Castagna

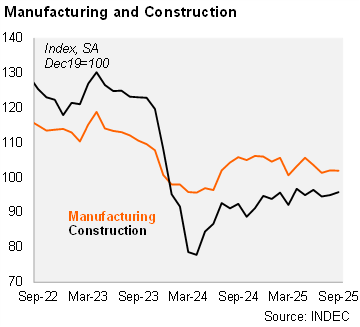

Manufacturing fell sequentially in September. The IPI manufacturing index decreased by 0.1% mom/sa in September, after growing by 0.7% in August. Thus, industry output fell by 2.3% qoq/sa in 3Q25, following a 0.5% expansion in 2Q25. On an annual basis, manufacturing fell by 0.7% in September and by 2.0% in 3Q25. Five of nine sectors grew on an annual basis in September.

Construction expanded in September. The construction index rose by 0.9% mom/sa in September, after growing 0.4% in the previous month. Moreover, construction fell by 1.0% qoq/sa in 3Q25 (+2.4% qoq/sa in 2Q25). Construction activity increased by 6.8% yoy in September and by 2.9% yoy in the quarter ended in that month. Employment in the sector increased by 3.3% relative to August 2024 (figures have a one-month lag). According to a qualitative survey, 67% of those involved in private construction expect no changes in activity levels over the next three months. Meanwhile, 9.7% expect an increase and 23.3% anticipate a decline. Among companies primarily engaged in public works, 22.2% anticipate a decrease in activity levels during the next three months, while 64.5% expect no change and 13.3% expect an increase.

Our take: Although construction and manufacturing showed mixed results in September, both indices contracted sequentially in 3Q25. Therefore, we anticipate that the monthly GDP proxy (EMAE) for September, to be published on 25 November, will indicate that the economy experienced a technical recession in 3Q25. Our GDP growth forecast for 2025 stands at 3.8%, primarily due to a high carryover from last year.