2026/01/08 | Diego Ciongo & Soledad Castagna

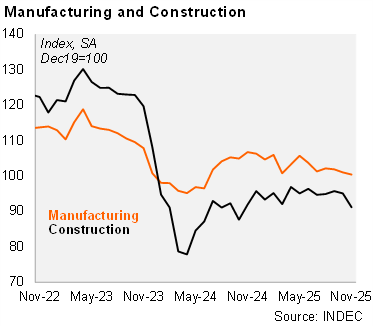

Manufacturing fell sequentially in November. The IPI manufacturing index decreased by 0.6% MoM SA in November, marking the third consecutive drop. Thus, industry output fell by 1.2% QoQ SA in the quarter ended in November, following a 1.8% contraction in the previous month. On an annual basis, manufacturing fell by 8.7% in November and by 4.0% in the quarter ended in that month. All sectors contracted on an annual basis in November.

Construction also dropped in November. The construction index fell by 4.1% MoM SA in November, after falling 0.7% in the previous month. Moreover, construction contracted by 1.4% QoQ SA in the quarter ended in November (-0.2% QoQ SA in October). Construction fell by 4.7% YoY in November but rose 3.5% in the quarter ended in that month. Employment in the sector increased by 3.5% relative to October 2024 (figures have a one-month lag). According to a qualitative survey, 68.5% of those involved in private construction expect no changes in activity levels over the next three months. Meanwhile, 13% expect an increase and 18.5% anticipate a decline. Among companies primarily engaged in public works, 24% anticipate a decrease in activity levels during the next three months, while 54% expect no change and 22% expect an increase.

Our take: Our GDP growth forecast for 2025 stands at 4.5% despite weaker construction and manufacturing data in November. The monthly GDP proxy for November will be published on January 21. For 2026 we expect 3.5% GDP growth driven by lower interest rates and a more favorable investment outlook.