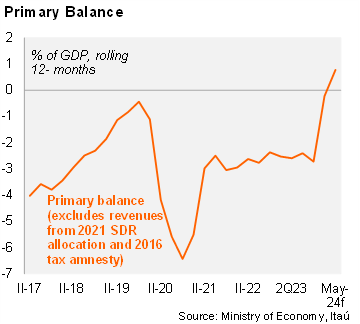

Argentina’s treasury ran another primary surplus in May, reaching ARS 2232.2 billion, significantly above the deficit of ARS 247.7 billion posted one year earlier. The nominal fiscal balance stood at ARS 1183.6 billion, also printing positive after a deficit of ARS 631.1 billion in the same month one year ago. As a result, the primary balance during the first five months of the year reached 1.0% of GDP, while the nominal balance stood at 0.4% of GDP. Based on these figures, we estimate a consolidated nominal deficit of around 1.5% of GDP year to date (including net interest payments from the central bank), narrowing from 4.3% in the same period of 2023.

Real tax revenues fell in the quarter ended in May, but a slower pace than previous months. Tax collection fell by 1.7% yoy in real terms in the period, after dropping by 4.8% in 1Q24. Total real revenues decreased by 2.5% yoy in the period (-5.0% in 1Q24). Income tax and foreign trade taxes played a key role in the recovery of revenues in recent months.

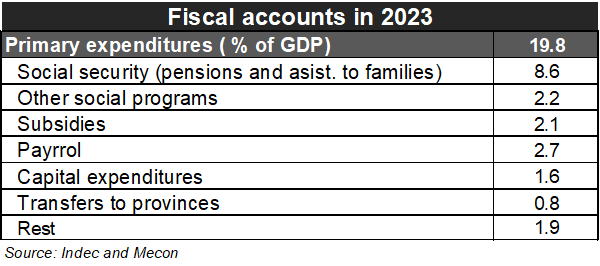

Real primary expenditures plummeted in the quarter ended in May. Primary expenditures fell by 27.0% yoy in real terms in the period, compared with a 34.7% yoy drop in 1Q24. Pension payments were down 24.2% yoy (-35.6% in 1Q24), while payrolls decreased by 17.1% yoy (+19.4% in 1Q24), both affected by the sharp acceleration of year-over-year inflation. Capital expenditures collapsed by 80.5% yoy (-86.9% in 1Q24) due to the freezing of public works. Energy subsidies decreased by 22.6% yoy, compared with a drop of 48.7% in 1Q24. On the other hand, expenses in social programs fell by 13.7% yoy, while transfers to provinces crashed by 74.4% yoy.

Our take: Our fiscal primary balance forecast stands at +0.5% of GDP for 2024 (still below the primary surplus of 1.7% of GDP in 2024 agreed with the IMF). However, if finally, the Lower Chamber approves the fiscal package without the Senate’s changes, we estimate additional tax revenues of ~0.5% of GDP for this year. The solid budget surplus registered in May also adds upward bias for our fiscal forecasts.