2025/09/10 | Diego Ciongo & Soledad Castagna

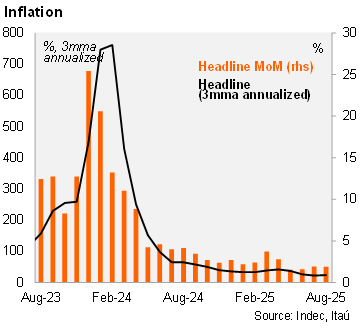

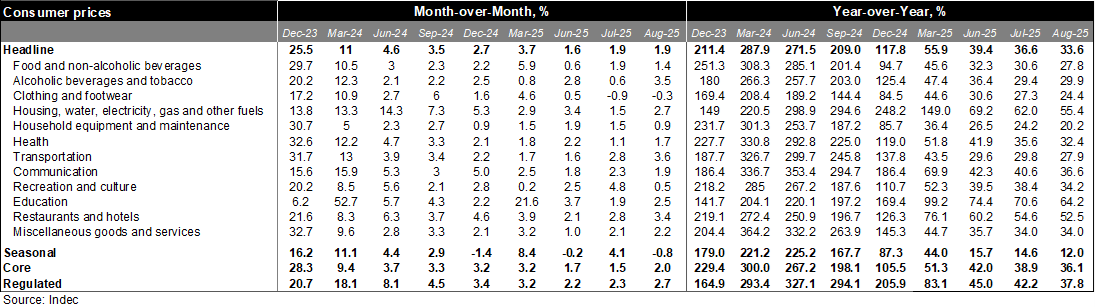

According to Argentina’s statistical office (INDEC), consumer prices rose by 1.9% MoM in August, repeating the pace from the previous month. The print was below the central bank's survey median of 2.1% MoM and shows a limited exchange rate pass-through as the ARS accumulated an 11% nominal depreciation against the USD in the last two months. On an annual basis, inflation fell to 33.6%, from 36.6% in July, also supported by an annual base effect. Annualized quarterly inflation in August rose to 24.0%, up from 22.3% in the previous month.

The monthly core measure rose by 2.0% MoM in August, up from 1.5% in the previous month reflecting a weaker ARS. Moreover, the annual core reading fell to 36.1%, down from 38.9% in July. Prices for regulated products increased by 2.7% MoM and 37.8% YoY led by higher transport prices (cars and fuels). Finally, seasonal product prices decreased 0.8% MoM in August due to lower clothing and footwear and some fruit and vegetable prices. The seasonal annual reading fell to 12.0% in August, down from 14.6% the previous month.

Our take: Our YE25 inflation forecast stands at 28.5%, with upside risks given the persistent depreciation of the ARS. Pass-through has been contained, so far, aided by weaker economic activity. The INDEC will release CPI for the month of September on October 14. Preliminary estimates suggest an acceleration in the monthly reading to a range of 2.0%–2.2%, given the recent depreciation of the ARS.