We recently revised our YE25 inflation forecast up to 30.5% from 29.5% in our previous scenario due to our expectation of weaker ARS after the October 26 midterm election.

2025/10/14 | Diego Ciongo & Soledad Castagna

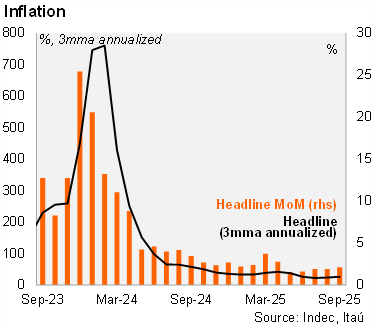

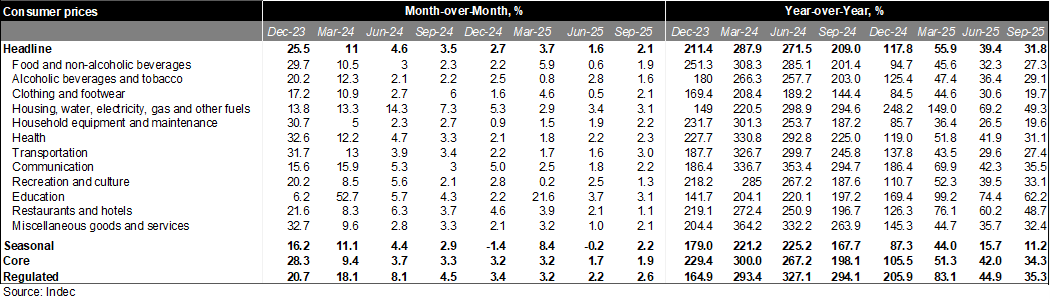

According to Argentina’s statistical office (INDEC), consumer prices rose by 2.1% MoM in September, accelerating from the previous month. The print was in line with the central bank's survey median of 2.1% MoM and shows a limited exchange rate pass-through with the ARS experiencing a nominal depreciation of 13% against the USD in September. On an annual basis, inflation fell to 31.8%, from 33.6% in August, also supported by an annual base effect. Annualized quarterly inflation in September rose to 26.4%, up from 24.0% in the previous month.

The monthly core measure rose by 1.9% MoM in September, down from 2.0% in the previous month. Moreover, the annual core reading fell to 34.3%, down from 36.1% in August. Prices for regulated products increased by 2.6% MoM and 35.3% YoY. Finally, seasonal product prices increased 2.2% MoM in September due to some fruit and vegetable prices. The seasonal annual reading fell to 11.2% in September, down from 12.0% the previous month.

Our take: We recently revised our YE25 inflation forecast up to 30.5% from 29.5% in our previous scenario due to our expectation of weaker ARS after the October 26 midterm election. Looking ahead, we are assuming a limited pass-through for the rest of the year. INDEC will release the CPI for October on November 12. Preliminary estimates from the central bank survey suggest a median monthly reading of around 2.0% (0.3 p.p. above the previous estimation).