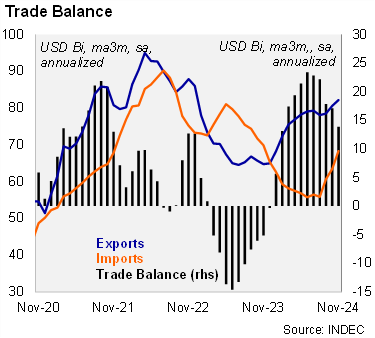

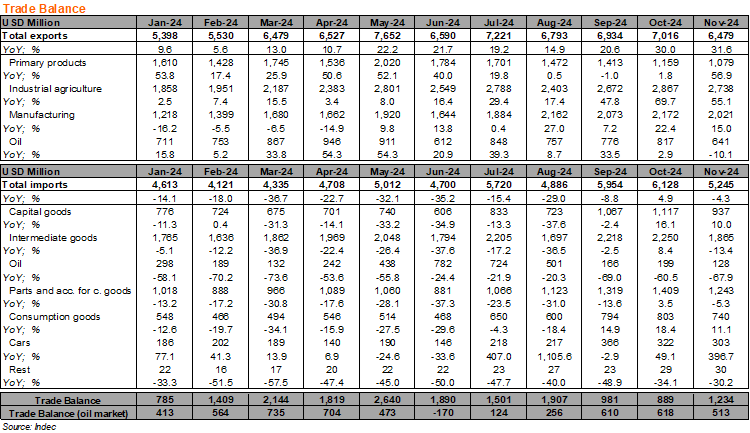

The trade balance reached a surplus of USD 1.2 billion in November, well above the USD 0.6 billion deficit registered in the same month of 2023. The surplus was above market expectations according to the central bank's survey, with analysts estimating a surplus of USD 0.7 billion. The 12-month rolling trade balance rose to a surplus of USD 18.2 billion in November, up from USD 16.4 billion in the previous month. At the margin, the seasonally-adjusted annualized trade balance fell to a surplus of USD 13.9 billion in November, from a surplus of USD 16.6 billion in the previous month.

Exports increased in the quarter ended in November, still driven by the normalization of the agricultural sector, after last year’s severe drought. Total exports rose by 27.1% yoy in the period, following an 18.2% gain in 3Q24. Agricultural exports, including manufactured agricultural products, expanded by 40.1% yoy in the period (from 20.6% yoy in 3Q24). Exports of other industrial products rose by 14.6% yoy in the same period, led by metals (up from an increase of 11.0% yoy in 3Q24). On a sequential basis, exports rose by 18.3% qoq/saar in November.

Imports fell in the quarter ended in November, but at a softer pace. Total imports fell by 2.9% yoy in the quarter ended in November (from a drop of 17.9% yoy in 3Q24). However, imports rebounded by 130.9% qoq/saar in the period. Imports of intermediate goods fell by 2.6% yoy in the period, while imports of capital goods decreased by 0.2% yoy, while imports of consumer goods (including cars) increased 23.8% yoy.

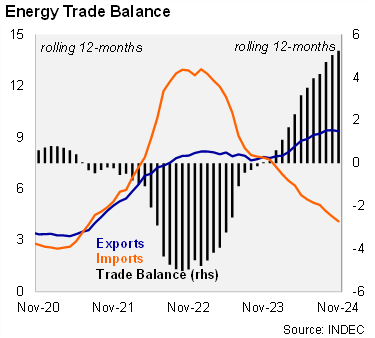

The energy trade surplus widened further in November. The rolling 12-month balance reached USD 5.2 billion in November, from a surplus of USD 5.0 billion in the previous month and only USD 0.1 billion in 2023. Energy imports plummeted by 65.7% yoy in the quarter ended in November, while oil exports rose by 7.0% yoy in the same period.

Our take. We see upside risks to our USD 17 billion trade surplus for 2024. For 2025 we still expect a surplus of USD 12 billion driven by lower commodity prices and higher imports consistent with a recovery in economic activity.