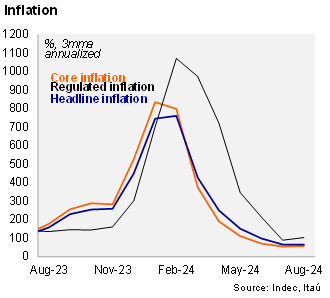

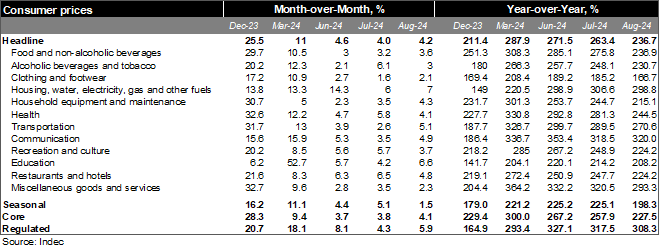

According to Argentina’s INDEC, consumer prices rose by 4.2% MoM in August, up from 4.0% MoM in the previous month. The print came in slightly above our call (4.0%) and market expectations of 3.9%, according to the latest central bank’s survey. Of note, the August print was also an upside surprise relative to the BCRA’s forecast of 3.9%. Annualized quarterly inflation in August fell to 64.9% during the quarter ended in that month, down from 65.3% in the previous month. On an annual basis, inflation declined to 236.7%, from 263.4% in July.

The monthly core measure increased by 4.1% MoM in August, marking an acceleration from the previous three months (3.7% MoM in average), driven by higher home rental prices. However, the year-over-year reading fell to 227.5%, from 257.9% in July. Prices for regulated products increased by 5.9% MoM and 308.3% YoY, led by electricity and public transport prices. Finally, prices for seasonal products increased by 1.5% MoM and 198.3% YoY.

Our Take: Despite the upside surprise in the August’s print, we expect further disinflation in the coming months, as a result of exchange rate dynamics, one-off effects of import tariffs reductions, and subdued demand-side pressures. Thus, we still foresee downside risks for our 130% inflation forecast by YE24. INDEC is scheduled to release September’s CPI on October 10.

Andrés Pérez M.

Diego Ciongo

Soledad Castagna