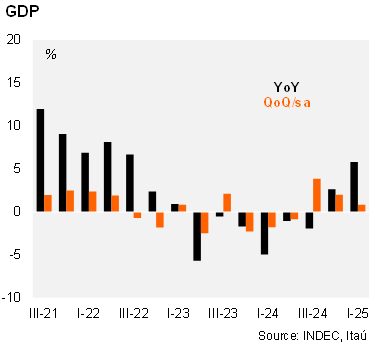

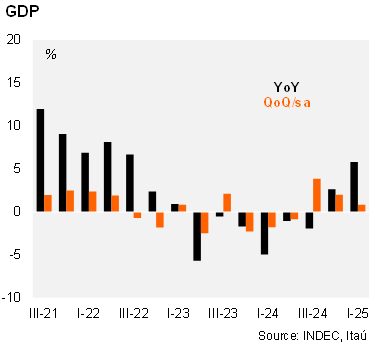

We forecast 2025 GDP growth at 5.2%, mainly due to tracking in 1Q25.

2025/06/23 | Andrés Pérez M., Diego Ciongo & Soledad Castagna

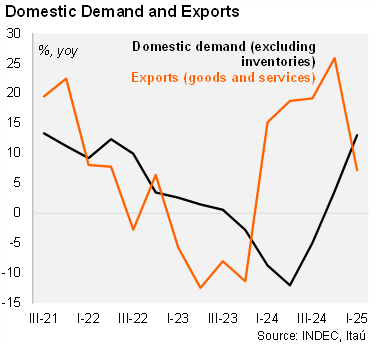

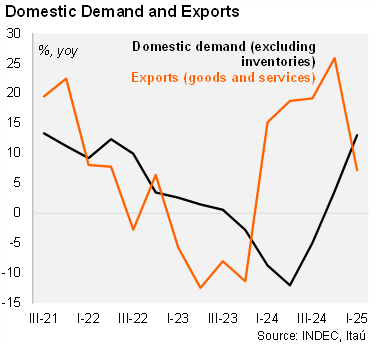

Final domestic demand – led by investment and private consumption – rose by 3.8% qoq/sa in 1Q25, from 5.1% in the previous quarter. Fixed investment increased by 9.8% in the quarter followed by an expansion in private consumption of 2.9%. Public consumption fell 0.1%. On an annual basis, domestic demand (excluding inventories) rose by 13.0% yoy, reflecting a 11.6% yoy increase in private consumption and a 31.8% gain in gross fixed investment. However, public consumption fell by 0.8%. Regarding external demand, exports increased by 7.2% yoy, while imports rose by 42.8% yoy.

Final domestic demand – led by investment and private consumption – rose by 3.8% qoq/sa in 1Q25, from 5.1% in the previous quarter. Fixed investment increased by 9.8% in the quarter followed by an expansion in private consumption of 2.9%. Public consumption fell 0.1%. On an annual basis, domestic demand (excluding inventories) rose by 13.0% yoy, reflecting a 11.6% yoy increase in private consumption and a 31.8% gain in gross fixed investment. However, public consumption fell by 0.8%. Regarding external demand, exports increased by 7.2% yoy, while imports rose by 42.8% yoy. Our take: We forecast 2025 GDP growth at 5.2%, mainly due to tracking in 1Q25. In our view, the recent removal of certain capital controls and changes to the exchange rate framework should lead to more investment, while falling inflation contributes to greater private consumption. A positive outcome for the government in the midterm elections would create a more favorable environment for investment.

Our take: We forecast 2025 GDP growth at 5.2%, mainly due to tracking in 1Q25. In our view, the recent removal of certain capital controls and changes to the exchange rate framework should lead to more investment, while falling inflation contributes to greater private consumption. A positive outcome for the government in the midterm elections would create a more favorable environment for investment.

GDP expanded in 1Q25. Output increased by 0.8% qoq/sa, after growing by 2.0% qoq/sa in the previous quarter. Growth in the quarter was well below the 1.5% outlined by the monthly GDP proxy (EMAE). On an annual basis, GDP grew by 5.8% in 1Q25, marking the second consecutive annual expansion. Moreover, the statistical carryover for 2025 stood at 4.0%.

Final domestic demand – led by investment and private consumption – rose by 3.8% qoq/sa in 1Q25, from 5.1% in the previous quarter. Fixed investment increased by 9.8% in the quarter followed by an expansion in private consumption of 2.9%. Public consumption fell 0.1%. On an annual basis, domestic demand (excluding inventories) rose by 13.0% yoy, reflecting a 11.6% yoy increase in private consumption and a 31.8% gain in gross fixed investment. However, public consumption fell by 0.8%. Regarding external demand, exports increased by 7.2% yoy, while imports rose by 42.8% yoy.

Final domestic demand – led by investment and private consumption – rose by 3.8% qoq/sa in 1Q25, from 5.1% in the previous quarter. Fixed investment increased by 9.8% in the quarter followed by an expansion in private consumption of 2.9%. Public consumption fell 0.1%. On an annual basis, domestic demand (excluding inventories) rose by 13.0% yoy, reflecting a 11.6% yoy increase in private consumption and a 31.8% gain in gross fixed investment. However, public consumption fell by 0.8%. Regarding external demand, exports increased by 7.2% yoy, while imports rose by 42.8% yoy. Our take: We forecast 2025 GDP growth at 5.2%, mainly due to tracking in 1Q25. In our view, the recent removal of certain capital controls and changes to the exchange rate framework should lead to more investment, while falling inflation contributes to greater private consumption. A positive outcome for the government in the midterm elections would create a more favorable environment for investment.

Our take: We forecast 2025 GDP growth at 5.2%, mainly due to tracking in 1Q25. In our view, the recent removal of certain capital controls and changes to the exchange rate framework should lead to more investment, while falling inflation contributes to greater private consumption. A positive outcome for the government in the midterm elections would create a more favorable environment for investment.