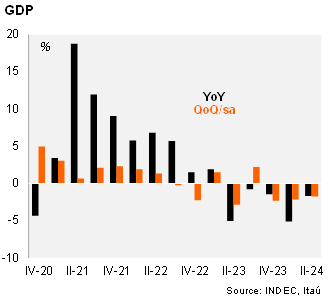

GDP fell in 2Q24 by 1.7% yoy, worse than anticipated data from the monthly GDP proxy (EMAE: -1.4% yoy), reflecting the effects of the stabilization program and despite the normalization of the agriculture sector after last year’s severe drought. On a sequential basis, GDP contracted by 1.7% QoQ/SA, following a contraction of 2.2% in 1Q24, falling for the third consecutive quarter. Thus, the statistical carryover for 2024 stood at -4.8%.

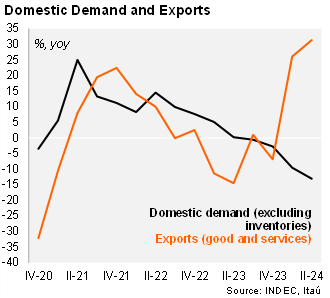

Final domestic demand fell by 4.5% QoQ/SA in 2Q24. Private consumption contracted by 4.1% QoQ/SA, while public consumption dropped by 1.1%. Fixed investment plummeted sequentially by 9.1% in the quarter. On an annual basis, domestic demand (excluding inventories) declined by 13.1% yoy, reflecting a 9.8% yoy contraction in private consumption (amid a sharp drop of real wages) and a drop of 6.0% in public consumption, in line with the fiscal adjustment. Gross fixed investment plummeted by 29.4% in the period. Regarding external demand, exports increased by 31.4% yoy, supported by the normalization of the agriculture sector after last year’s severe drought, while imports dropped by 22.5% yoy affected by a weaker currency.

Our take: We recently revised our 2024 GDP growth forecast to -4.0% (from -3.5%), mainly due to the negative statistical carryover from 2Q24 anticipated in the monthly GDP proxy. We expect economic activity to gradually improve from 3Q24, as several leading indicators have shown green shoots, such as personal loans, VAT collection, construction, manufacturing and auto sales.