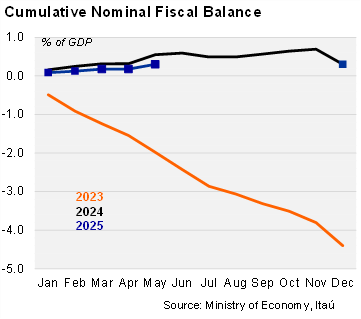

As expected, Argentina’s treasury ran another primary surplus in May of ARS 1.697 billion, below the surplus of ARS 2.332 billion posted one year earlier. The nominal fiscal balance also posted a surplus of ARS 662.1 billion, also below the surplus of ARS 1.183 billion in May 2024. Consequently, the cumulative primary balance reached an estimated surplus of 0.8% of GDP during the first five months of the year, while the cumulative nominal balance stood at 0.3% of GDP surplus.

Real tax revenues decreased in the quarter ended in May, due to a base effect on income taxes resulting from the financial sector's extraordinary revenue last year. Total real revenues decreased by 5.1% yoy in the quarter ended in May after growing 1.3% in 1Q25. Tax collection fell by 3.5% yoy in real terms in the period after growing by 4.3% in 1Q25.

Primary expenditures decreased in the quarter ended in May. Primary expenditures fell by 0.6% yoy in real terms in the period, after growing 10.8% yoy in 1Q25 due to a base effect. Pension payments were up 21.3% yoy in real terms (+35.6% in 1Q25) amid the significant drop in inflation. On the other hand, energy subsidies fell by 71.0% yoy, compared with a drop of 55.5% in 1Q25, while payrolls decreased by 6.6% yoy (-4.1% in 1Q25). Capital expenditure decreased by 12.1% yoy, after growing 38.0% in 1Q25. On the other hand, transfers to provinces increased by 151.8% year over year (YoY), which was affected due to base effects as they were frozen in the same period last year.

Our Take: Our primary budget surplus forecast for this year stands at 1.6% of GDP, in line with the official target.