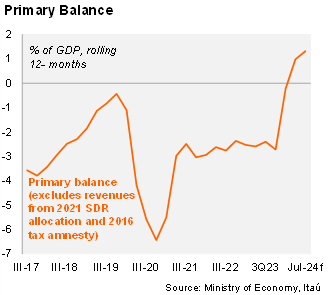

Argentina’s treasury ran another primary surplus in July, reaching ARS 908.3 billion, significantly above the deficit of ARS 334.4 billion posted one year earlier. The nominal fiscal balance posted a deficit of ARS 601 billion (the first in the year), but well below the deficit of ARS 754.2 billion of July 2023. As a result, the primary balance during the first seven months of the year reached a surplus of 1.4% of GDP, while the nominal balance stood at +0.4% of GDP. Based on these figures, we estimate a consolidated nominal deficit of around 1.4% of GDP year to date (including net interest payments from the central bank), narrowing from 5.8% in the same period of 2023.

Real tax revenues fell in the quarter ended in July affected by weak activity. Tax collection fell by 3.7% yoy in real terms in the period, after dropping by 3.9% in 2Q24. Total real revenues decreased by 7.1% yoy in the period (-5.6% in 2Q24).

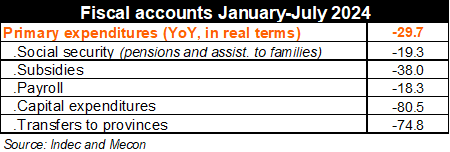

Real primary expenditures continue falling. Primary expenditures declined by 30.9% yoy in real terms in the period, compared with a 30.0% yoy drop in 2Q24. Pension payments were down 18.3% yoy (-19.8% in 2Q24), while payrolls decreased by 21.0% yoy (-17.2% in 2Q24), both affected by the sharp acceleration of year-over-year inflation. Capital expenditures were down sharply by 77.6% yoy (-76.7% in 2Q24) due to the freeze on public works. Energy subsidies fell by 44.6% yoy, compared with a drop of 44.2% in 2Q24. On the other hand, expenses in social programs fell by 35.3% yoy, while transfers to provinces plunged by 75.0% yoy.

Our take: Our primary fiscal balance forecast stands at +1.0% of GDP, significantly above the deficit of 2.7% of GDP in 2023 due to the ongoing fiscal adjustment. August’s fiscal data should be published on September 19.