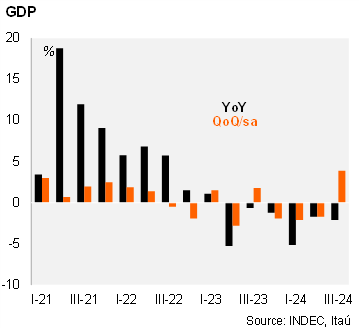

GDP expanded by 3.9% QoQ/SA, after contracting in the previous three quarters. The rebound was greater than anticipated by the GDP proxy EMAE (3.4% QoQ/SA in September). Thus, the statistical carryover for 2024 stood at -2.8%. On year-over-year basis, the GDP fell in 3Q24 by 2.1% yoy, reflecting the effects of the stabilization program and despite the normalization of the agriculture sector after last year’s severe drought.

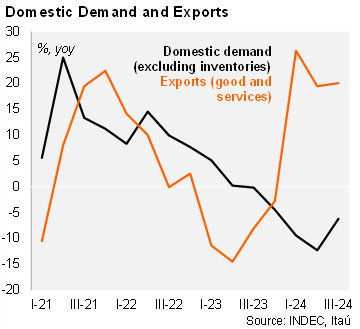

Final domestic demand expanded by 5.3% QoQ/SA in 3Q24. Private consumption increased by 4.6% QoQ/SA, while public consumption rose by 0.7%. Fixed investment rebounded sequentially by 12.0% in the quarter. On an annual basis, domestic demand (excluding inventories) declined by 6.2% yoy, reflecting a 3.2% yoy contraction in private consumption (amid an annual drop of real wages) and a contraction of 4.0% in public consumption, in line with the fiscal adjustment. Gross fixed investment plummeted by 16.8% in the period. Regarding external demand, exports increased by 20.1% yoy, supported by the normalization of the agriculture sector after last year’s severe drought, while imports dropped by 11.7% yoy affected by a weaker currency.

Our take: A stronger-than-expected sequential recovery in 3Q24 poses an upside risk to our 2024 GDP forecast of -3.0%. We recently revised our GDP growth forecast for 2025 to 4.2% (from 4.0%), mainly due to the expected recovery in real wages and a better investment environment. The faster than anticipated exit from the recession takes place as fiscal surpluses have persisted, inflation has surprised to the downside, and government approval remains elevated.