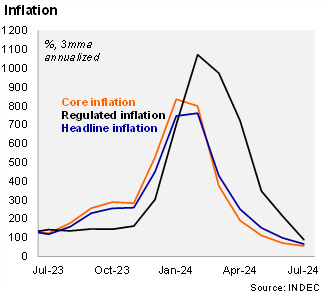

Consumer prices rose by 4.0% MoM in July, marking the lowest reading since January 2022. The print came in between our call (4.1%) and market expectations of 3.9%, according to the latest central bank’s survey. Annualized quarterly inflation in July fell to 65.3% during the quarter ended in that month, down from 98.3% in 2Q24. On an annual basis, inflation declined to 263.4%, from 271.5% in June.

The monthly core measure increased by 3.8% MoM in July (slightly above the previous month), bringing the year-over-year reading to 257.9%, down from 267.2% in June. Prices for regulated products increased by 4.3% MoM and 317.5% YoY, led by electricity and fuel prices. Finally, prices for seasonal products increased by 5.1% MoM and 225.1% YoY.

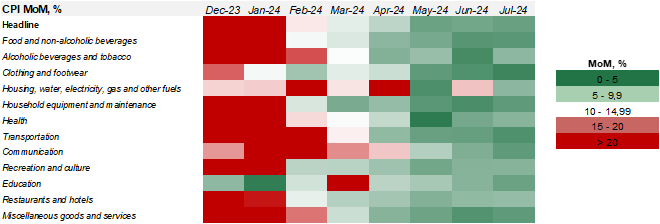

Our heatmap shows that 100% of selected items (on a month-on-month basis) rose by single-digits in July, from 92% in the previous month and only 8% in December 2023.

Our Take: Our inflation forecast stands at 130% for YE24. However, a continuation of the central bank's crawling peg policy (monthly depreciation pace of 2.0%), and the absence of demand-side pressures introduce downside risks to our forecast. Of note, survey-based inflation expectations continue to edge down.