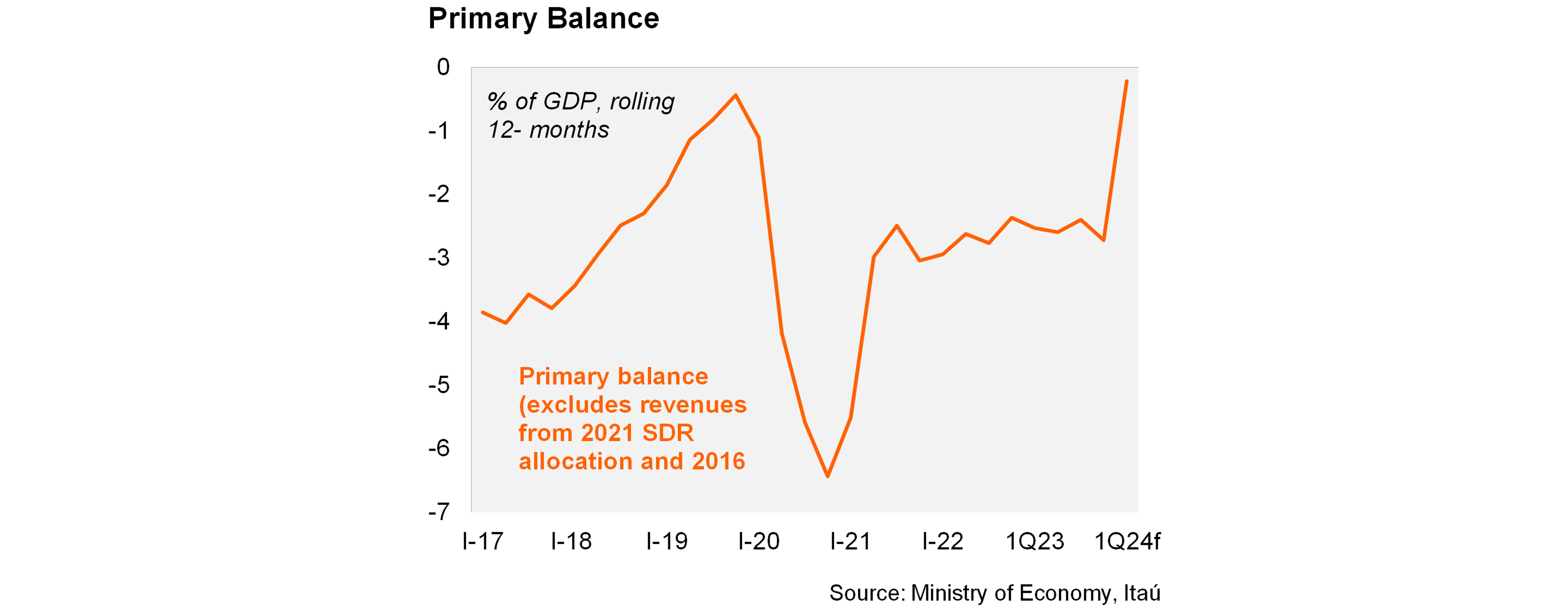

Argentina’s treasury ran another primary surplus in March, reaching ARS 625.0 billion, snapping back from the deficit of ARS 257.9 billion posted one year earlier. The nominal fiscal balance stood at ARS 276.6 billion, also printing positive after a deficit of ARS 388.0 billion in the same month one year ago. As a result, the primary balance during 1Q24 reached 0.6% of GDP, while the nominal balance stood at 0.2% of GDP, the first positive quarterly fiscal balance since

2008

Real tax revenues fell in 1Q24, amid weak activity. Tax collection fell by 4.8% yoy in real terms in the quarter, after dropping by 11.7% in 4Q23. Total real revenues decreased by 5.0% yoy in the period (-7.7% in 4Q23).

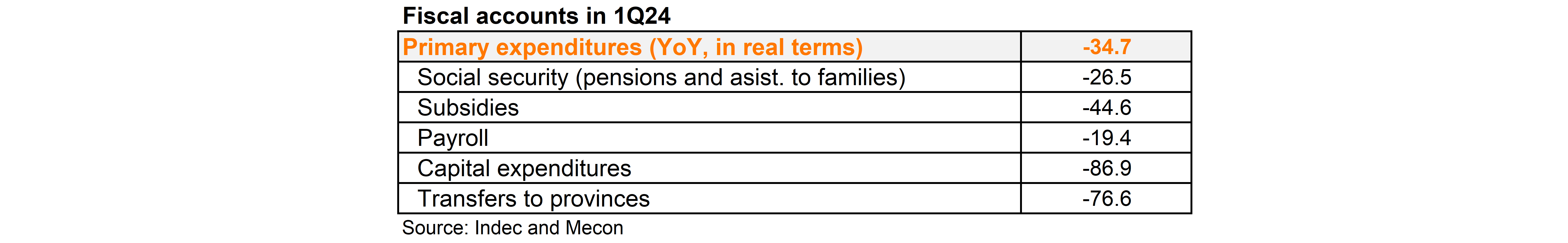

Real primary expenditures plummeted in 1Q24. Primary expenditures fell by 34.7% yoy in real terms in 1Q24, compared with a 3.7% yoy drop in 4Q23. Pension payments were down 35.6% yoy (-16.9% in 4Q23), while payrolls decreased by 19.4% yoy (+11.3% in 4Q23), both affected by the sharp acceleration of inflation. Capital expenditures collapsed by 86.9% yoy (-21.0% in 4Q23) due to the freezing of public works. Energy subsidies decreased by 48.7% yoy, compared with a drop of 10.4% in 4Q23. On the other hand, expenses in social programs fell by 17.7% yoy, while transfers to provinces crashed by 76.6% yoy.

Our take: We recently improved our fiscal accounts forecasts. The fiscal results of the administration are impressive so far, comfortably exceeding IMF targets. We now envisage a primary fiscal surplus of 0.5% of GDP in 2024 (from 0% of GDP in our previous scenario). Although the beginning of the year is promising for fiscal accounts, maintaining steep expenditure contractions to achieve a primary surplus appears challenging in a stagflationary scenario. That being said, an approval of the fiscal package in discussion in Congress could further improve our fiscal forecasts.

Andrés Pérez M.

Diego Ciongo