2025/12/23 | Diego Ciongo & Soledad Castagna

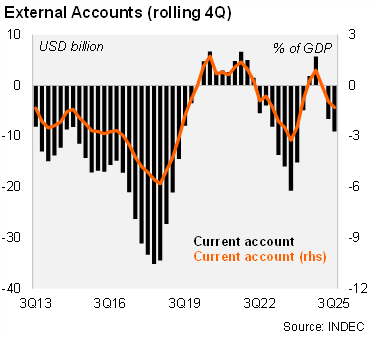

The current account showed a deficit of USD 1.6 billion in 3Q25, from a surplus of USD 0.9 billion in the same quarter of 2024, led by small goods surplus and a large services deficit.

A small goods trade surplus in 3Q25. Exports increased by 13.8% YoY while imports rose by 24.6% YoY. Thus, the goods trade balance printed at a surplus of USD 4.3 billion in the period, down from a surplus of USD 5.3 billion in the same quarter of 2024. On the other hand, the service account deficit widened to USD 2.6 billion, from a deficit of USD 1.6 billion one year earlier, due to a deterioration of the travel accounts amid strong ARS in real terms. The deficit for the income balance (net interest bill and dividend payments) narrowed to USD 3.9 billion, from a deficit of USD 3.2 billion in 3Q24.

International reserves increased by USD 0.4 billion during 3Q25. External debt stood at USD 317 billion in 3Q25 (45.4% of GDP), from USD 282 billion in 3Q24 (46.1% of GDP).

Our take: We see upside risks for our current account forecast of -1.9% of GDP in 2025, given higher-than-expected trade surplus in 4Q25.