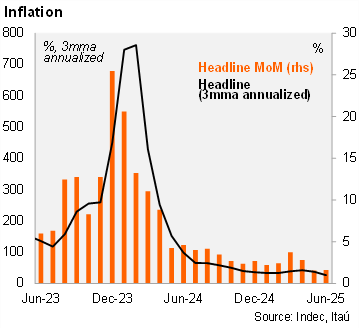

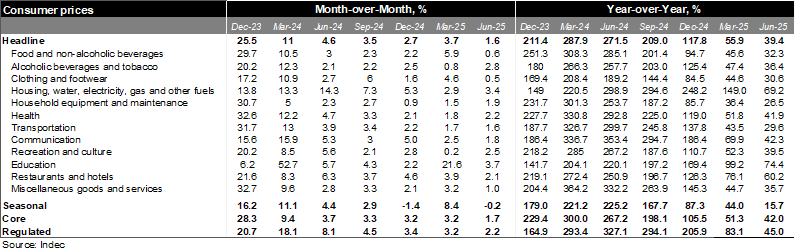

According to Argentina’s statistical office (INDEC), consumer prices rose by 1.6% MoM in June, slightly up from 1.5% MoM in May. The print was slightly below the central bank's survey median of 1.8% MoM and was the third consecutive downside surprise relative to the Bloomberg median. On an annual basis, inflation declined to 39.4%, from 43.5% in May, also supported by an annual base effect. Annualized quarterly inflation in June fell to 26.6%, down from 37.5% in the previous month.

The monthly core measure rose by 1.7% MoM in June, down from 2.2% in the previous month. Thus, June's figure was the lowest since May 2020, during the pandemic, and since 1Q18, excluding that period. Moreover, the annual core reading fell to 42.0%, down from 44.7% in May. Prices for regulated products increased by 2.2% MoM and 45.0% YoY led by higher gasoline prices. Finally, prices for seasonal products fell by 0.2% MoM due to lower fruits and vegetable prices, with the annual reading falling to 15.7% in June, from 21.1% in the previous month.

Our take: Our inflation forecast stands at 28.5% for YE25. While inflation has surprised largely to the downside over the last rolling quarter, the disinflation path over the next few months is likely to reflect the roughly 12% nominal depreciation since mid-June lows. The INDEC will release CPI for the month of July on August 13.