2025/12/16 | Diego Ciongo & Soledad Castagna

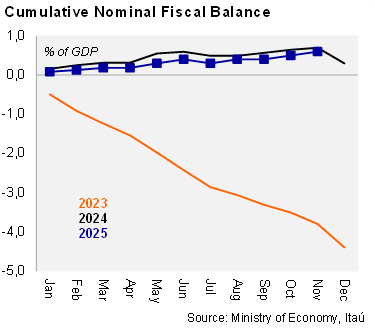

As expected, Argentina’s treasury ran another fiscal surplus in November. Thus, the primary fiscal balance posted a surplus of around 0.3% of GDP, while the nominal fiscal surplus reached 0.1% of GDP in November. Consequently, the cumulative primary balance reached an estimated surplus of 1.7% of GDP during the first eleven months of the year, while the cumulative nominal balance stood at +0.6% of GDP.

Real tax revenues decreased in the quarter ended in November. Total real revenues fell by 5.1% YoY in the quarter ended in November after dropping 0.8% in 3Q25. Tax collection fell by 7.9% YoY in real terms in the period after falling by 3.2% in 3Q25. The weak performance of tax collection during this period was explained by a drop in export duties following their temporary suspension during October, coupled with a decline in VAT and income tax due to likely soft consumption.

Primary expenditures declined in the quarter ended in November. Primary expenditures fell by 5.1% YoY in real terms in the period, after falling 2.4% YoY in 3Q25. Payrolls decreased by 11.3% YoY (-9.1% in 3Q25), while transfers to provinces fell by 34.1% YoY (-20.4% in 3Q25). Furthermore, capital expenditure decreased by 7.0% YoY, after falling 12.9% in 3Q25. On the other hand, energy subsidies rose by 2.0% YoY, compared with a drop of 25.2% in 3Q25, while pension payouts rose by 7.5% YoY in real terms (+11.4% in 3Q25) amid the drop in the year-over-year inflation.

Our Take: Our primary surplus forecast for 2025 and 2026 stands at 1.5% of GDP, in line with the official forecast presented in the 2026 Budget bill. The disciplined management of the fiscal accounts supports this forecast.