2026/01/16 | Diego Ciongo & Soledad Castagna

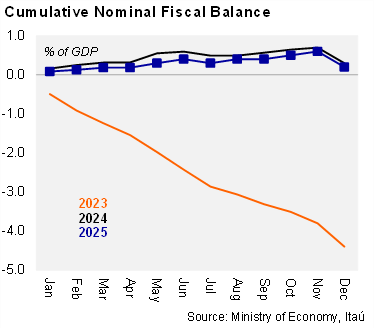

Argentina recorded a fiscal surplus in 2025 for the second consecutive year. The primary surplus reached 1.4% of GDP, down from 1.8% in 2024. The nominal fiscal surplus, including debt interest payments, was 0.2% of GDP, compared to 0.3% in 2024.

Real tax revenues decreased in 4Q25. Total real revenues fell by 6.4% YoY in 4Q25 after a 0.8% decline in 3Q25. Tax collection dropped by 7.3% YoY in real terms during the period, following a 3.2% decrease in 3Q25. The weak performance in tax collection was attributed to a drop in export duties due to their temporary suspension in October, along with a decline in VAT and income tax, likely due to soft consumption.

Primary expenditures declined in 4Q25. Primary expenditures fell by 3.9% YoY in real terms during the period, following a 2.4% YoY decrease in 3Q25. Payrolls decreased by 12.3% YoY (-9.1% in 3Q25) affected by higher inflation at the margin, while transfers to provinces fell by 21.4% YoY (-20.4% in 3Q25). Furthermore, capital expenditure decreased by 2.4% YoY, after falling 12.9% in 3Q25. On the other hand, energy subsidies fell by 5.3% YoY, compared with a drop of 25.2% in 3Q25, while pension payouts rose by 6.1% YoY in real terms (+11.4% in 3Q25) also affected by higher inflation at the margin.

Our Take: Our primary surplus forecast for 2026 stands at 1.5% of GDP, in line with the official forecast presented in the 2026 Budget, which was approved in extraordinary sessions by Congress at the end of 2025. This forecast is supported by disciplined fiscal management.