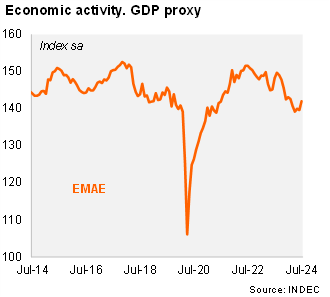

Activity expanded sequentially in July, after falling in June. According to the EMAE (official monthly GDP proxy), activity rose by a strong 1.7% MoM/SA in July, from a 0.3% MoM/SA drop in June. Despite the rebound in the month, activity still contracted by 0.2% QoQ/SA in the quarter ended in July (from -1.7% QoQ/SA in 2Q24). On an annual basis, activity fell by 1.3% in July (declining significantly less than the Bloomberg median of -4.2%) and contracting by 1.3% in the quarter ended in July (-1.7% yoy in 2Q24).

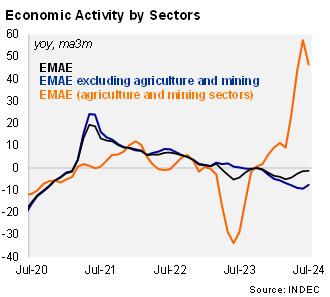

All sectors declined in the quarter ended in July (but at softer rate), except for agriculture. Construction fell by 20.1% yoy in the period (from -23.6% yoy in 2Q24), affected by the freezing of public works, while manufacturing contracted by 13.5% yoy in the same period (vs. a drop of 16.7% yoy in 2Q24). Services (including the commerce sector) fell by 4.5% yoy in the period (vs. -4.8% in 2Q24), likely affected by the decline in real wages. On the positive side, primary activities skyrocketed by 46.5% yoy in the quarter in July (vs.+57.4% yoy in 2Q24), reflecting the normalization of agriculture after last year's severe drought.

Our take: The sequential improvement in economic activity in July is in line with our view of a sequential recovery starting in 3Q24. All eyes will be on the sustainability of sequential growth in the coming months. Indeed, while other leading indicators such as cars production and sales, mineral production and personal loans continued to expand in August, with the next monthly GDP is scheduled for October 23rd. We recently revised our 2024 GDP growth forecast to -4.0% (from -3.5% in our previous scenario).