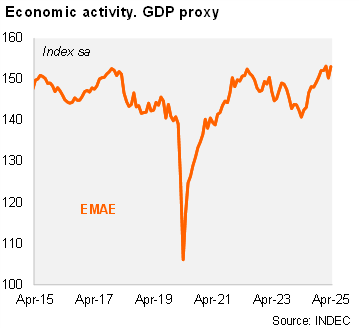

Activity increased sequentially in April, following a temporary decline in March. According to the EMAE (official monthly GDP proxy), economic activity bounced back by 1.9% MoM/SA in April, after a 1.9% MoM/SA contraction in March. Consequently, activity grew by 0.4% QoQ/SA in the quarter ended in April, after growing 0.8% QoQ/SA in the previous month (revised down from 1.5% after the publication of 1Q25’s national accounts). On an annual basis, activity rose by 7.7% in April and by 6.3% in the quarter ended in that month (+5.8% yoy in 1Q25). The statistical carryover for 2025 stood at 4.7%.

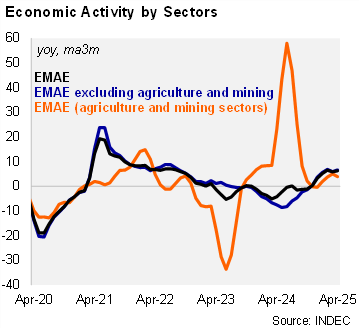

All sectors rose on an annual basis in the quarter ended in April. Primary activities rose by 3.9% YoY during this period (compared to +5.1% YoY in 1Q25), while manufacturing expanded by 5.6% YoY in the same period (vs. a gain of 5.1% YoY in 1Q25). Services (including the commerce sector) rose by 3.8% YoY in the period (vs. 2.2% in 1Q25), likely supported by the recovery of real wages. Construction rose by 10.9% YoY in the period (from 6.2% YoY in 1Q25) due to a base effect amid the freezing of public works in the same period of 2024.

Our take: We maintain our 2025 GDP growth forecast at 5.2%, primarily due to a high statistical carryover. In our view, the recent removal of certain capital controls and changes to the exchange rate framework should lead to more investment, while falling inflation contributes to greater private consumption. A positive outcome for the government in the midterm elections (October 26, 2025) would create a more favorable environment for investment.