2025/09/24 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

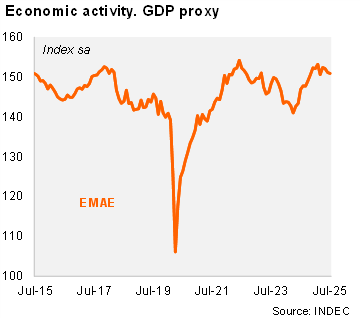

Yet to turn the corner… According to the EMAE (official monthly GDP proxy), economic activity fell slightly by 0.1% MoM/SA in July, after contracting by 0.6% MoM/SA in June and 0.2% MoM/SA in May. Consequently, activity decreased 0.5% in the quarter ended in July after falling 0.1% QoQ/SA in 2Q25. On an annual basis, activity rose by 2.9% in July and by 4.7% in the quarter ended in that month (+6.3% yoy in 2Q25). The statistical carryover for 2025 stood at 3.7%.

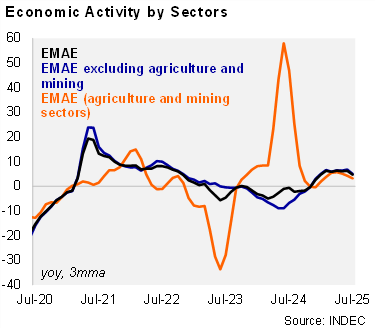

All sectors rose on an annual basis in the quarter ended in July, aided by base effects. Primary activities rose by 3.2% YoY during this period (compared to +4.3% YoY in 2Q25), while manufacturing expanded by 3.4% YoY in the same period (vs. a gain of 6.9% YoY in 2Q25). Services (including the commerce sector) rose by 3.7% YoY in the period (vs. 4.9% in 2Q25), likely supported by the recovery of real wages. Construction rose by 6.1% YoY in the period (from 10.6% YoY in 2Q25) due to a base effect amid the freezing of public works in the same period of 2024.

Our take: A technical recession is likely. We recently revised our 2025 GDP growth forecast down to 3.8% from 5.0%. According to the weak performance of leading indicators and the impact of high real interest rates on consumption amid political turmoil, a technical recession in 3Q25 is likely. The monthly GDP proxy for August will be published on 24 September.