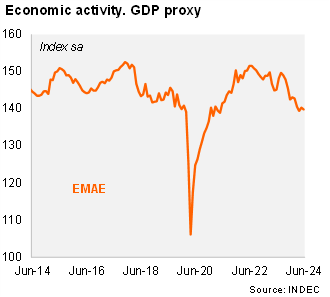

Activity declined sequentially in June, after a temporary rebound in May. According to the EMAE (official monthly GDP proxy), activity fell by 0.3% MoM/SA in June, from a 0.7% MoM/SA expansion in May. Thus, activity contracted by 1.6% QoQ/SA in the 2Q24 (from -2.2% QoQ/SA in 1Q24), the third consecutive quarterly sequential decline. On a year-over-year basis, activity fell by 3.9% in June (well below the Bloomberg median of -1.6%) and contracting by 1.4% in the 2Q24 (-5.1% yoy in 1Q24). The statistical carryover for 2024 now stands at -4.7%.

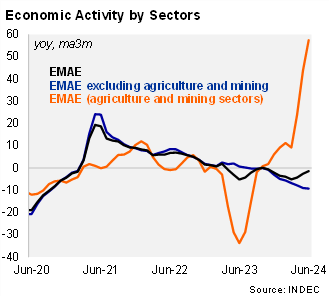

All sectors declined in 2Q24 with the exception of agriculture. Construction fell by 23.6% yoy in the second quarter (from -19.7% yoy in 1Q24), affected by the freezing of public works, while manufacturing contracted by 16.7% yoy in the same period (vs. a drop of 13.7% yoy in 1Q24). Services (including the commerce sector) registered a decline of 4.8% yoy in the period (vs. -2.4% in 1Q24), likely affected by lower real wages in the same period. On the positive side, primary activities rose by 57.4% yoy in 2Q24 (vs.+9.2% yoy in 1Q24), reflecting the normalization of agriculture after last year's severe drought.

Our take: Our GDP growth forecast for 2024 is -3.5%, now with downside risks due to the sizable negative statistical carryover from 2Q24. Our 2024 GDP forecast implies an important acceleration in activity, which seems challenging considering recent activity data and leading indicators. The 2Q24 GDP data will be published on September 18, and the next monthly GDP print (July) is scheduled for September 25.