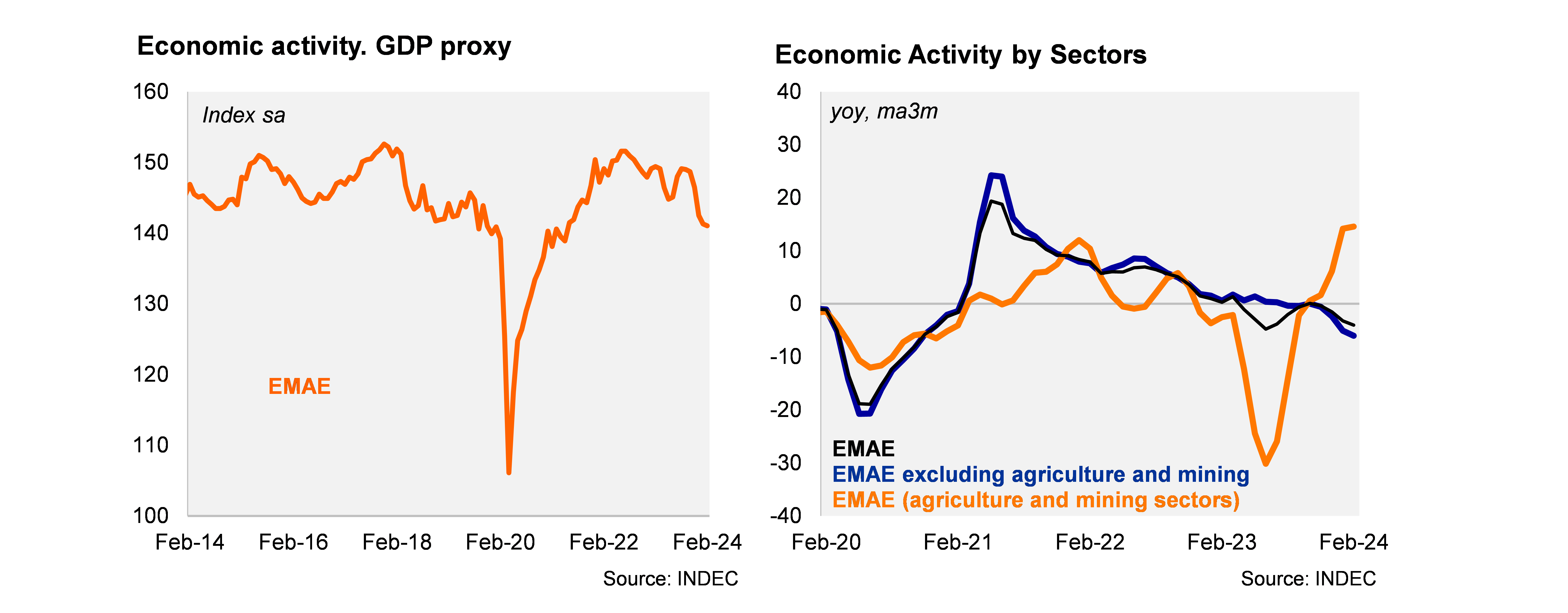

Activity contracted sequentially again in February. According to the EMAE (official monthly GDP proxy), activity fell by 0.2% MoM/SA in February (marking the sixth consecutive contraction), leading to a drop of 4.4% QoQ/SA in the quarter ended in February (down from -1.9% QoQ/SA in 4Q23). On a year-over-year basis, activity declined by 3.2% in February (falling less than the Bloomberg median of -6.0%) and contracting by 4.0% in the quarter ended in that month (-1.5% yoy in 4Q23).

Mixed results across sectors. Construction fell by 13.2% yoy in the quarter ended in February (from +1.1% yoy in 4Q23), affected by the freezing of public works, while manufacturing contracted by 12.1% yoy in the same period (vs. a drop of 6.2% yoy in 4Q23). On the positive side, primary activities rose by 14.6% yoy in the period (vs.+6.2% yoy in 4Q23), reflecting the normalization of agriculture after last year's severe drought, while services registered a gain of 1.3% yoy in the period (vs. 1.1% in 4Q23).

Our Take: Activity fell in the first two months of the year, affected by the fallout of the stabilization program. We still maintain our GDP growth forecast of -3.0% for 2024, affected by the expected drop in real wages and the sharp fiscal consolidation, but partially offset by the normalization of the agricultural sector after the severe drought in 2023.

Andrés Pérez M.

Diego Ciongo