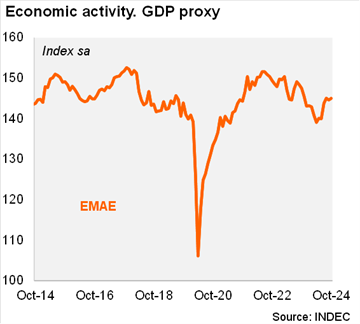

Activity rose sequentially in October. According to the EMAE (official monthly GDP proxy), economic activity expanded by 0.6% MoM/SA in October, following a revised 0.0% MoM/SA growth in September (from -0.3 MoM/SA originally). Thus, activity expanded by 3.0% QoQ/SA in October, after growing 3.9% QoQ/SA in September. On an annual basis, activity fell by 0.7% in October and contracted by 2.1% in the quarter ended in that month (-2.1% yoy in 3Q24). We noted that the seasonally adjusted GDP proxy exceeded the level of December 2023, leaving the recession behind and a statistical carryover of -2.6% for 2024.

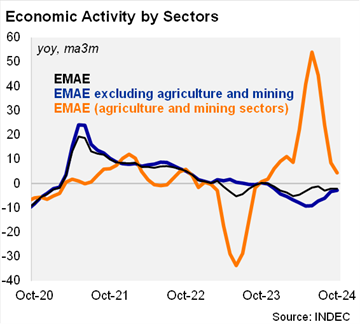

Most of the sectors contracted on an annual basis at the beginning of 4Q24 (but at a softer rate), as the effects of the stabilization measures fade. Construction fell by 16.4% YoY in the period (from -16.6% YoY in 3Q24), affected by the freezing of public works, while manufacturing contracted by 5.5% YoY in the same period (vs. a drop of 6.2% YoY in 3Q24). Services (including the commerce sector) fell by 3.4% YoY in the period (vs. -3.5% in 3Q24), likely affected by the decline in real wages on year-over-year basis. On the positive side, primary activities rose by 4.4% YoY in the quarter ended in October (vs.+8.5% YoY in 3Q24), still reflecting the normalization of agriculture after last year's severe drought.

Our take: The recovery in activity remains on track, supported by the recovery in real wages. In fact, real wages expanded by 1.9% mom in October, marking the seventh consecutive monthly gain. We recently revised our 2024 forecast to -3.0% (now with risks title to a lower drop) from -3.5% in our previous scenario. For 2025, we expect an expansion of 4.2%. In our view, a higher statistical carry-over, the recovery in real wages and a better investment environment support our call. The November 2024 EMAE figures will be published on 23 January.