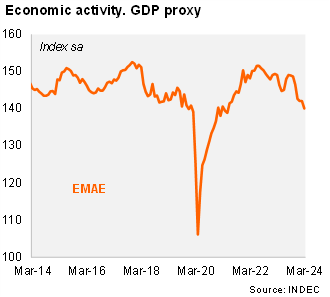

Activity contracted sequentially in March. According to the EMAE (official monthly GDP proxy), activity fell by 1.4% MoM/SA in March, leading to a drop of 3.0% QoQ/SA in 1Q24 (down from -1.9% QoQ/SA in 4Q23). March’s print is the sharpest sequential decline this year, and the largest since the 2.6% MoM/SA decline of December 2023. On an annual basis, activity declined by 8.4% in March (falling more than the Bloomberg median of -7.3%) and contracting by 5.4% in the first quarter of the year (-1.5% yoy in 4Q23).

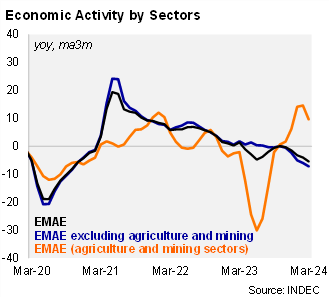

All sectors contracted in 1Q24, except for the primary sector. Construction fell by 21.5% yoy in 1Q24 (from +1.1% yoy in 4Q23), affected by the freezing of public works, while manufacturing contracted by 14.0% yoy in the same period (vs. a drop of 6.2% yoy in 4Q23). Services (including commerce) fell by 0.8% yoy in 1Q24 (+1.1% in 4Q23) affected by a severe decline in real wages (-18.7% yoy in the same period). On the positive side, primary activities rose by 9.6% yoy in the period (vs.+6.2% yoy in 4Q23), reflecting the normalization of agriculture after last year's severe drought.

Our Take: The adjustment in Argentina marches on, with sharper declines in economic activity taking place as nominal variables have also adjusted faster than expected. As a result, our 2024 GDP call for a contraction of 3.0% has downside risks, despite the normalization of the agriculture sector.