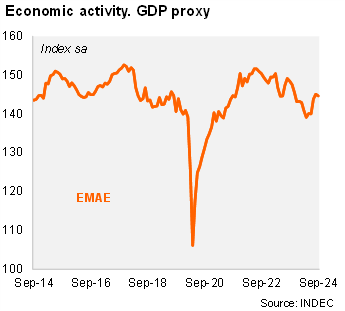

Activity fell in September compared with the previous month, but the previous two months were revised up, leading to strong growth in 3Q24. According to the EMAE (official monthly GDP proxy), economic activity declined by 0.3% MoM/SA in September, following a revised 0.9% MoM/SA increase in August (from 0.2 MoM/SA originally) and 2.7% MoM/SA (up from 2.1% MoM/SA) in July. Thus, activity expanded by 3.4% QoQ/SA in 3Q24, after falling in the three previous quarters. On an annual basis, activity fell by 3.3% in September and contracted by 2.6% in 3Q24 (-1.7% yoy in 2Q24). We noted that the seasonally adjusted GDP proxy exceeded the level of December 2023, leaving the recession behind and a statistical carryover of -3.1% for 2024.

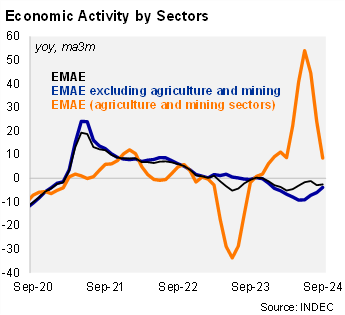

Most of the sectors contracted on an annual basis in 3Q24 (but at a softer rate), as the effects of the stabilization measures fade. Construction fell by 16.6% YoY in the period (from -22.2% YoY in 2Q24), affected by the freezing of public works, while manufacturing contracted by 6.2% YoY in the same period (vs. a drop of 17.4% YoY in 2Q24). Services (including the commerce sector) fell by 3.5% YoY in the period (vs. -4.9% in 2Q24), likely affected by the decline in real wages. On the positive side, primary activities rose by 8.5% YoY in 3Q24 (vs.+54.1% YoY in 2Q24), reflecting the normalization of agriculture after last year's severe drought.

Our take: The sequential rebound in economic activity in 3Q24 was stronger than expected after the upward revisions of the previous months, leading to a higher statistical carry-over for 2024. As a result, we see upside risks to our 2024 forecast of -3.5%. For 2025, we expect an expansion of 4.0%. In our view, a higher statistical carry-over, the recovery in real wages and a better investment environment support our call. The national accounts data for 3Q24 will be released on December 16 and will be key to seeing if they confirm the recovery anticipated for the period.