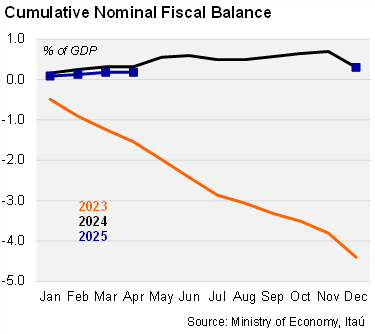

As expected, Argentina’s treasury ran another primary surplus in April of ARS 845.9 billion, above the surplus of ARS 265.0 billion posted one year earlier. The nominal fiscal balance also posted a surplus of ARS 572.3 billion, also well above the surplus of ARS 17.4 billion in April 2024. As a result, the primary balance reached an estimated surplus of 0.6% of GDP in the first four months of the year, while the nominal balance stood at 0.2% of GDP surplus.

Real tax revenues rose in the quarter ended in April, driven by the recovery of economic activity. Total real revenues increased by 2.6% yoy in the month after growing 1.3% in 1Q25. Tax collection rose by 6.2% yoy in real terms in April, after growing by 4.3% in 1Q25 supported by income taxes, VAT, and social security contributions.

Primary expenditures increased in the quarter ended in April, still influenced by an annual base effect. Primary expenditures rose by 5.1% yoy in real terms in April, after growing 10.8% yoy in 1Q25. Pension payments were up 31.5% yoy in real terms (+35.6% in 1Q25) amid the significant drop in inflation. On the other hand, energy subsidies fell by 74.0% yoy, compared with a drop of 55.5% in 1Q25, while payrolls decreased by 7.1% yoy (-4.1% in 1Q25). On the other hand, capital expenditure increased by 18.0% yoy (38.0% in 1Q25), while transfers to provinces increased by 191.9% yoy, affected by base effects as both items were frozen at the beginning of last year.

Our Take: Our primary budget surplus forecast for this year stands at 1.6% of GDP, in line with the official target. The persistence of the revenue recovery is a welcome development, which should moderate the pressure from the demanding base effects on last year’s spending cuts.