2025/11/21 | Diego Ciongo & Soledad Castagna

At today's monthly monetary policy meeting, the BCP kept the monetary policy rate at 6.0% for the twentieth consecutive month, in line with our call and market expectations (according to the BCP’s survey).

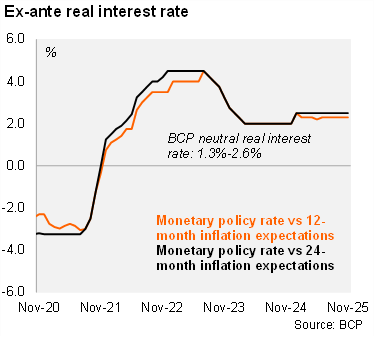

The Committee reaffirmed its commitment to price stability and will continue to closely monitor internal and external developments to anticipate their potential impact on inflation. Additionally, as has frequently been stated, it will take appropriate measures to ensure compliance with the 3.5% target over the monetary policy horizon. Therefore, we estimate that the real ex-ante policy rate will remain at 2.5% (based on expectations for the monetary policy horizon), compared to the BCP’s neutral real interest rate range of 1.3%-2.6%.

Furthermore, the committee highlighted that the economic activity and sales indicators continued to show strong momentum. In terms of prices, year-on-year inflation has slowed in recent months, reflecting, in part, the effect of the appreciation of the PYG on the prices of non-food goods—particularly durable goods—and certain services. The strengthening of the local currency, in addition to the decline in international oil prices, also contributed to the reduction in local fuel prices. With economy activity around its potential level, inflation expectations in line with the target, and lower exchange rate pressures, the BCP foresees inflation to be around 4.0% at the end of 2025 and 3.5% during 2026.

Our take: We forecast a policy rate of 6.00% through the rest of 2025 and 2026. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. Although inflation expectations for the monetary policy horizon (18–24 months) are anchored, economic activity is growing well above its potential (3.5%) and local currency liquidity is at minimum levels. This introduces the risk of higher rates over time. The last monthly monetary policy meeting of the year is scheduled for December 22.