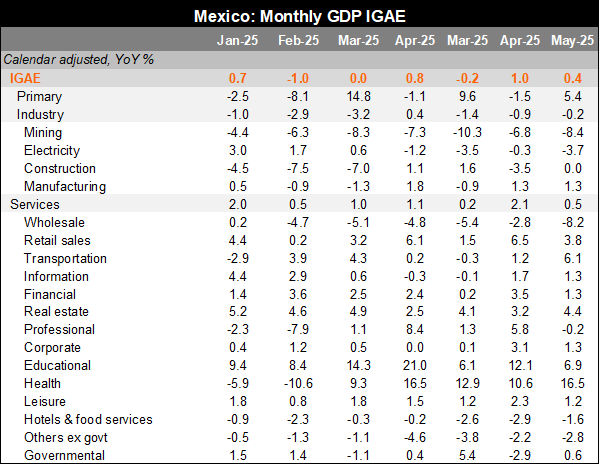

Economic activity fell by 0.2% YoY in May, below both Bloomberg’s market consensus and our forecast (+0.4% and +0.5%, respectively). INEGI revised the previous month downward for the second consecutive time, resulting in a deeper contraction for April. After adjusting for calendar effects, activity rose by 0.4%, driven by the positive performance of the services sector (+0.5%, with 10 out of 14 subsectors showing growth) and the agricultural sector (+5.4%, following a contraction in April). Calendar-adjusted growth took place despite a contraction in industry (-0.2%, with declines in mining and electricity).

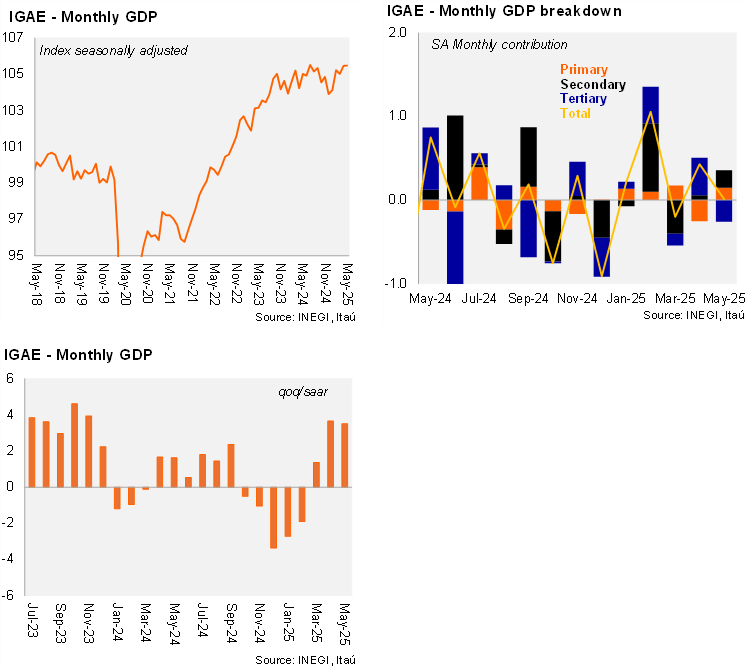

When considering seasonally adjusted figures, the economy was essentially flat (IGAE nowcast at +0.3% MoM). By sector, industrial production grew by 0.6% MoM due to growth in construction, manufacturing, and electricity. Primary activities increased by 3.6% MoM, following a deep contraction in April. Services decreased by 0.4%, with negative performances in 6 out of 14 subsectors, including retail sales, financing services, and leisure.

Our view: Despite the negative surprise, today's release kept the quarterly positive bias as of May, with the QoQ/SAAR at +3.5% and a broad-based positive performance across sectors. The carry-over for 2025 stands at +0.5%. Looking ahead, we expect the economy to continue decelerating on an annual basis, as the government remains squarely focused on strengthening domestic activity amid changes in the global outlook. We forecast modest GDP growth of 0.2% in 2025.

See details below