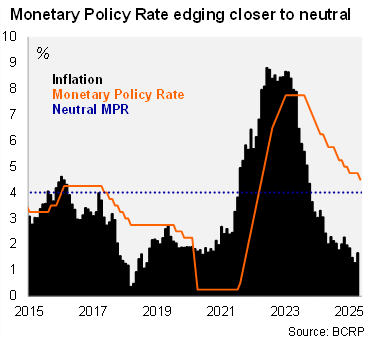

At its monthly monetary policy meeting, the Central Bank of Peru (BCRP) surprised by cutting its policy rate by 25 bps to 4.5%. The Bloomberg median and our call expected the BCRP to extend the pause at 4.75% since January, amid elevated global uncertainty. The BCRP’s communiqué once again indicated that the policy rate is nearing neutral and maintained a data-dependent guidance. However, the statement omitted the usual phrase following a rate cut that says, "this move does not necessarily imply a cycle of successive cuts."

The BCRP's communiqué highlights an increasingly complex external backdrop, marked by a slower convergence of inflation to target levels across several economies and a more subdued outlook for global economic activity amid persistent uncertainty and restrictive trade measures. In this context, the BCRP acknowledged ongoing volatility in global financial markets and a deterioration in global growth prospects.

Domestically, the Board highlighted an expected increase in inflation, along with stable inflation expectations that are comfortably within the target range of 1-3%. Twelve-month inflation expectations rose slightly to 2.29% in April, which would bring the one-year real ex-ante rate to 2.21%, edging closer to the 2.0% neutral real rate. Activity indicators worsened somewhat compared to the previous month, but they remained optimistic amid activity around potential. In fact, the Central Bank’s monthly Macroeconomic Expectations Survey, also released last night, had analysts revising growth down slightly to 3% in 2025 (from 3.1-3.2% in the March survey). The 2026 forecast stands between 2.8% and 3%.

Our Take: We expect the BCRP to continue cutting throughout the course of the year with pauses in between, ending the year at 4.25%. The next monthly monetary policy meeting will be held on June 10.