2026/01/30 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

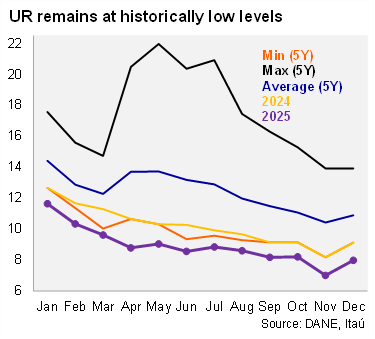

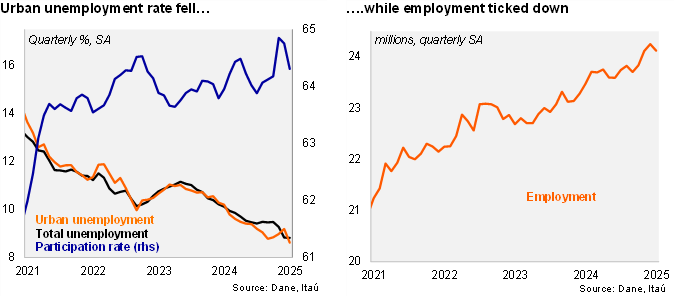

The national unemployment rate in December came in at 8.0%, down 1.1pp over one year, while the urban unemployment rate closed at 7.8% (dropping 1.2pp over one year). The urban unemployment rate was below the Bloomberg median of 8.1% and our 8.0% call. National unemployment increased 2.6% YoY in December (+4.2% in November), while the labor force rose by 1.3% YoY (+2.9% previously). The participation rate dropped by 0.1pp from December 2024 to 64.3%. Sequentially, employment dropped by 0.5% MoM/SA from November, and rose 1.6% between 3Q25 and 4Q25. Meanwhile, the unemployment rate (SA) remained stable from November at 8.3%. In 4Q25 the unemployment rate (SA) fell by 0.4pp from 3Q25 to 8.5%, and remains below the NAIRU rate of 10.2% (SA), indicating that the labor market continues to generate inflationary pressures. The unemployment rate for 2025 came in at 8.9%, down from 10.2% registered in 2024, the lowest level since records began (2001).

Improving employment dynamics boosted by services. During 4Q25, employment growth increased 3.6% YoY, above the 2.7% in 3Q25. The increase was pulled up by private salaried posts (+5.2% YoY, +5.5% in 3Q25), while self-employment posts increased by 2.2% YoY (+1.4% in 3Q25). Conversely, public sector jobs returned to positive territory, increasing mildly by 1.0% YoY (-4.8% in 3Q25), after 10 consecutive months of declines. Hotels and restaurants, transport, and public administration were key job drivers in the 4Q25, while manufacturing shed jobs. In 2025, employment increased 3.4% YoY (+1.1% in 2024).

Our take: Despite the favorable labor market performance through 2025, after the significant minimum wage increase, we expect the average unemployment rate to increase this year to 10.2%.