2025/09/30 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

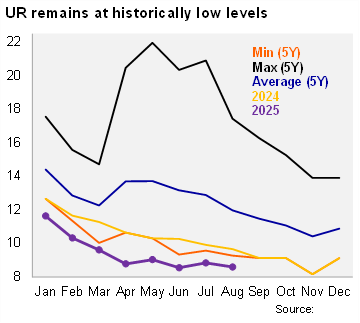

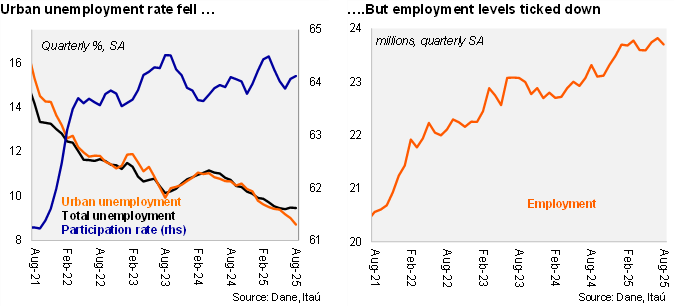

In August, the unemployment rate remained at historically low levels, despite employment falling sequentially. According to DANE’s August labor market report, the national unemployment rate reached 8.6%; down 1.1pp over one year, while the urban unemployment rate stood at 7.8% in August, a drop of 2.2pp over one year, below the Bloomberg market consensus of 8.3% and our 8.1% call, and the lowest level since records began (2001). Employment rose by 1.7% YoY in August (+3.3% YoY in July), while the labor force increased by 0.5% (+2.1% in the previous month). The participation rate fell by 0.6pp from August 2024 to 63.9%. Sequentially, employment dropped by 0.5% (+0.3% previously), while the unemployment rate (SA) remained stable at 9.0%. Meanwhile, the urban unemployment rate (SA) dropped to 8.0% (-0.3pp MoM; BanRep’s NAIRU: 10.2%).

Private and self-employment payrolls were the main job creators in August. In the quarter ending August, employment increased by 2.9% YoY (+3.2% in July; +3.2% in the 2Q25). This annual increase was driven by a 4.9% YoY increase in private salaried posts (+2.7% in 2Q25), while self-employment posts rose by 2.8% (+5.7% in the previous quarter). Conversely, public sector jobs fell by 1.5% (-0.8% in the 2Q25). Financial and insurance services, real estate, construction and transport sectors were key job drivers this month.

Our take: The favorable trend through the year persisted in August. We foresee an average unemployment rate this year of 9.0% for 2025 (10.2% in 2024). Given the combination of a strong labor market, high inflation, and fiscal imbalances, BanRep faces limited scope for monetary easing in the near term.