2025/12/09 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

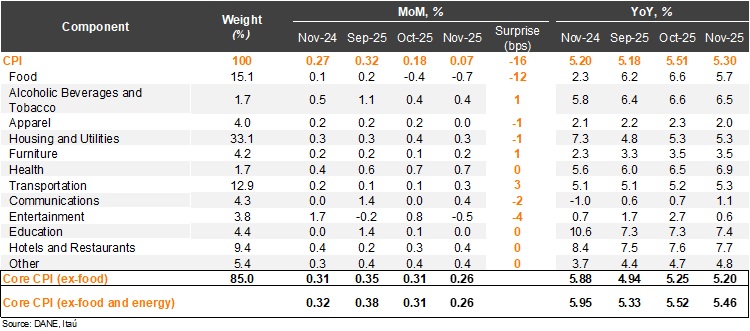

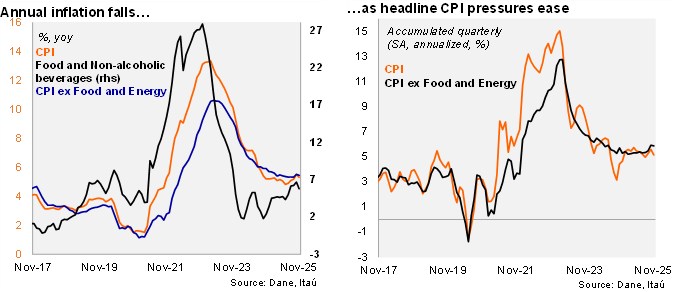

After four consecutive months of rising annual inflation, November brought some relief. Consumer prices rose 0.07% MoM in November, well below the Bloomberg market consensus of 0.20% and our 0.23% call. The main positive contributors in the month were housing and utilities (+0.28%; +9bps), hotels and restaurants (+0.38%; +4bps) and transport prices (+0.29%; +4bp). Meanwhile, food prices dropped by 0.7% MoM, subtracting 14bps. Food prices explained most of the surprise relative to our forecast. Consumer prices excluding food rose by 0.26% (+0.31% one year earlier), while inflation excluding food and energy increased by 0.26% MoM (+0.32% one year ago). On an annual basis, headline inflation fell by 21bps from October to 5.3% in November, while core inflation fell by 6bps to 5.46%. Year-to-date inflation sits at 5.15% (5.13% in October), well above the central bank’s 3% target.

Non-durable goods inflation ticks down, while services inflation remained high. Non-durable goods inflation (mainly food) came in at 4.86% YoY, falling by 35 bps from the previous month. Meanwhile, energy inflation increased by 6 bps to 3.0% YoY, amid a low base effect. Durable goods inflation remained stable from the previous month at a low 0.63% YoY. Services inflation dropped by 13 bps to 6.26% (9.51% peak in September 2023). At the margin, we estimate inflation accumulated in the quarter reached 5.2% (SA, annualized, stable from 3Q25). Core inflation stood at 5.9%, up from 5.5% in 3Q25 (SA, annualized).

Our take: Our preliminary estimate for December’s monthly inflation, scheduled for release on January 8, ranges between 0.3% and 0.4%, resulting in the annual CPI print falling mildly to 5.2%. Strong indexation pressures combined with a slow pace of disinflation in rents and restaurants are keeping inflation above 5%. Consequently, BanRep will likely proceed cautiously, keeping the interest rate unchanged at 9.25% for a prolonged period of time.