2025/12/17 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

An even more favorable external backdrop. The baseline scenario considers slightly greater growth in Chile’s main trading partners for the policy horizon, higher copper prices (USD4.7 / lb on average for 2026), and somewhat lower oil prices (USD62). However, the report expresses concerns of a potential sharp risk reversal in global financial markets, consistent with the 2H26 Financial Stability Report. The BCCh baseline scenario considers two cuts by the Fed in 2026, as in the September IPoM (and in line with market pricing).

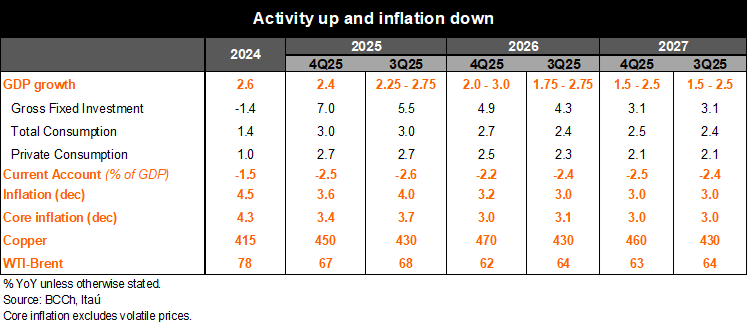

2026 GDP growth revised up, as expected. The IPoM forecasts 2025 GDP growth at 2.4% (from a range of 2.25% - 2.75%) and upgraded the 2026 growth range up by 25-bp (from 1.75%–2.75% to 2.0%–3.0%), driven by revisions to private consumption (from 2.3% to 2.5%) and investment (from 4.3% to 4.9%). As a result, the output gap forecast swung from a slightly negative path towards a moderately positive (peaking at +0.4% of GDP by 4Q26) throughout the policy horizon. This is the third consecutive upward revision to the output gap. 2025 potential growth was revised slightly up, although the point estimate was not mentioned.

A more benign inflation path. On inflation, as expected, the Central Bank lowered its year-end 2025 forecast for both headline inflation (from 4.0% to 3.6%) and core inflation (from 3.7% to 3.4%), consistent with downside surprises in October and November CPI prints. Implicitly, the BCCh expects a 0.05% MoM contraction for headline CPI for December (market prices at -0.14%), and a flat MoM for Core CPI. For yearend 2026, however, headline inflation was revised up to 3.2% (from 3.0%), while core inflation was slightly adjusted down to 3.0% (from 3.1%), implicitly signaling that the expected acceleration in inflation late next year would mainly come from volatile components.

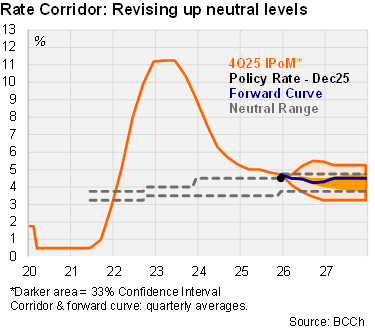

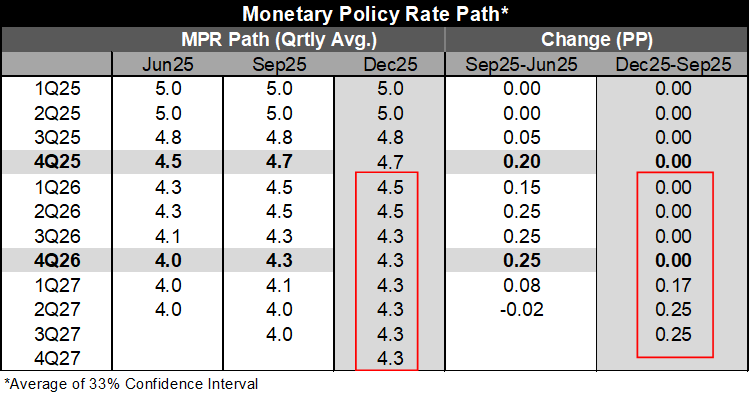

Regarding the policy rate corridor, the Central Bank kept the 2026 trajectory broadly unchanged but raised the midpoint of the 2027 corridor by about 25 basis points, in line with the higher neutral rate range, now estimated at 3.75%–4.75%. Overall, one final 25bp cut is expected in 2026, with the corridor suggesting it would take place in 3Q26.

Our take: All in all, the IPoM’s baseline scenario appears net hawkish, pointing to a long pause prior to delivering a final cut. We see the cycle concluding at 4.25% (-25bps) in June. Still, sticky services inflation amid recovering domestic demand will limit the scope for a deeper easing cycle. With expectations of growth picking up further, odds are tilted towards the BCCh staying at 4.5% for longer. The next monetary policy meeting is scheduled for January 27, coinciding with Kevin Cowan’s debut in the Board.