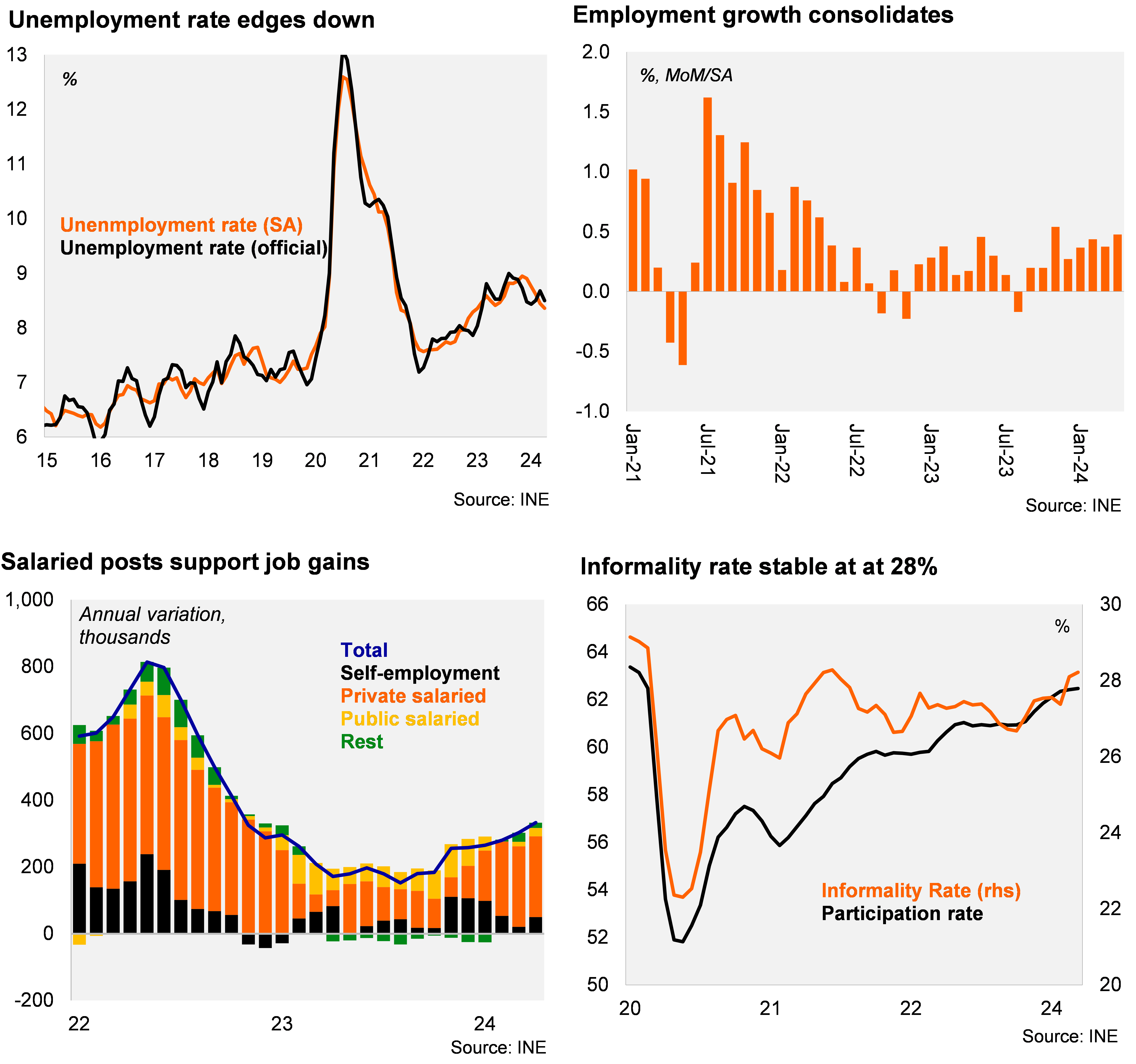

The unemployment rate for the moving quarter ending in April fell to 8.5%, below the BBG consensus of 8.6% and our call of 8.7%. The unemployment rate implies a 0.2pp fall over twelve months despite the participation rate increasing 1.6pp (to 62.5%, the highest since March 2020). At the margin, employment grew 0.5% MoM/SA, the eighth consecutive increase, taking the seasonally adjusted unemployment rate to 8.36% (8.45% in 1Q24; 9% cycle peak in the November quarter). Overall, survey-based labor market dynamics point to a gradual recovery. However, complementary information such as the stabilization of job openings at low levels, rising unemployment insurance beneficiaries (up 14% YoY in March), and higher-than-normal layoffs by firms, suggest further improvement in the labor market appears unlikely.

Annual job gains still led by salaried posts, with a rebound in public posts. Total employment grew by 3.7% YoY, up from 3.4% in 1Q24, while the labor force rose 4.4%. Total salaried posts increased 4.1% YoY during the quarter (3.9% in 1Q), with public salaried job increasing by 2.1% (1.2% in 1Q24), while private post up by a steady 4.5%. Self-employment increased by 2.6% (1.1% in 1Q). Viewed by economic sectors, job growth was lifted by commerce, public administration and transport. Separately, construction workers had a null growth over twelve months, in line with the view that the sector adjustment amid weak activity is near complete. Formal employment increased 2.5% YoY (2.4% in 1Q).

Informal posts on the rise at the margin. Informal jobs increased by 6.9% YoY (5.8% in 4Q), leading to an increase in the informality rate to 28.2% (28.3% average during 2018-19), up by 0.9pp over one year. Of note, job creation over the last two months has been concentrated in informal posts, posing risks to a further rise in informality. Formal job creation may remain subdued given several measures that have raised the cost of labor and reduced labor market flexibility.

Our Take: While the labor market has surprised favorably for several months, we believe slack still persists , preventing demand-side inflationary pressures. Our above target 4.1% call for the year contains significant supply-led factors, including the passthrough of prior CLP depreciation, indexation measures as well as fuel and energy adjustments. In this context, with medium-term inflation expectations anchored, we expect the BCCh to continue to cut rates at the upcoming meetings. We see a yearend policy rate of 5.25%, with risks titled towards further easing if global conditions allow. We forecast an average unemployment rate of 8.6% this year, down 0.1pp from 2023.

Andrés Pérez M.

Vittorio Peretti

Ignacio Martinez Labra