Itaú Unibanco has common and preferred shares that have been traded on the São Paulo Stock Exchange (now called B3) since 1944. The preferred shares have been traded on the NYSE in the form of ADRs (an ADR represents a preferred share) since February 21, 2002, in accordance with the requirements of the NYSE and SEC.

Since July 1980, Itaú Unibanco has been remunerating its stockholders by making monthly and additional payments (dividends and/or interest on capital), and distributed equally to common and preferred stockholders.

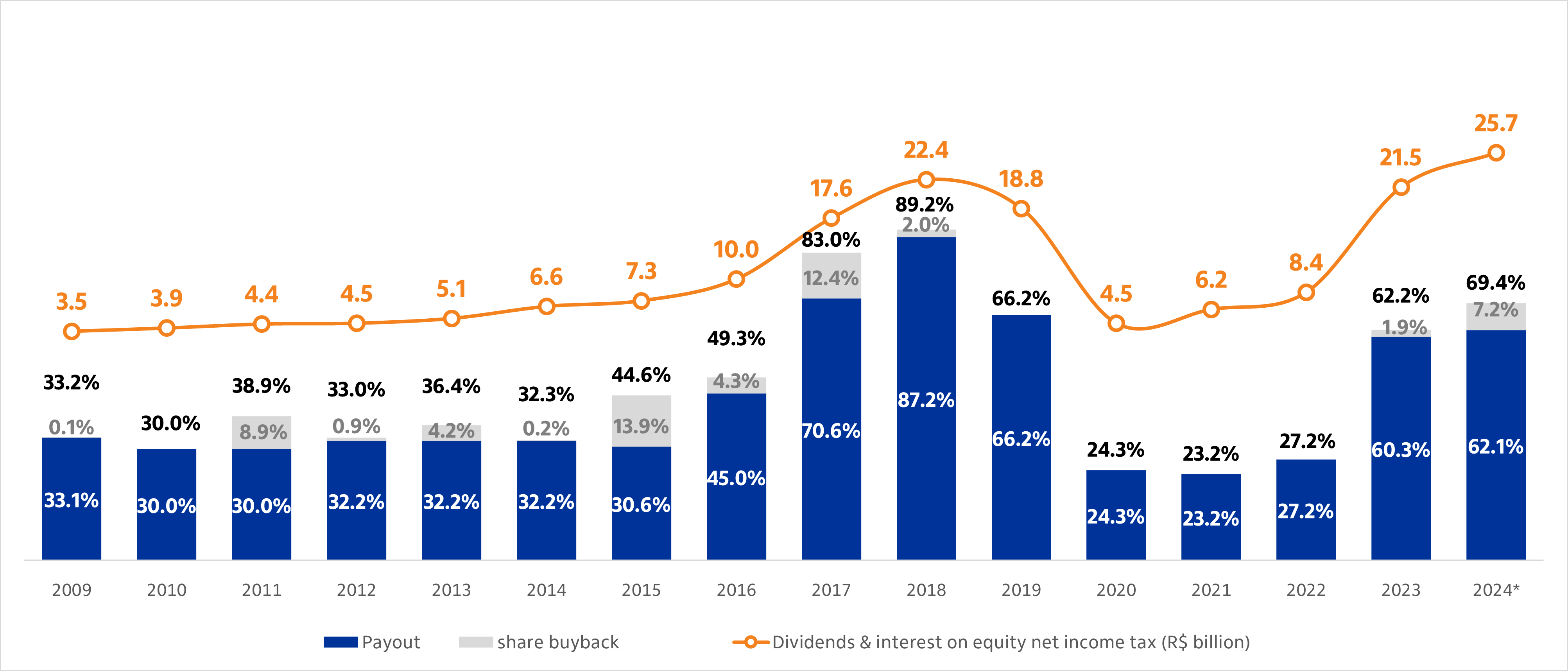

Historical series

Historical series