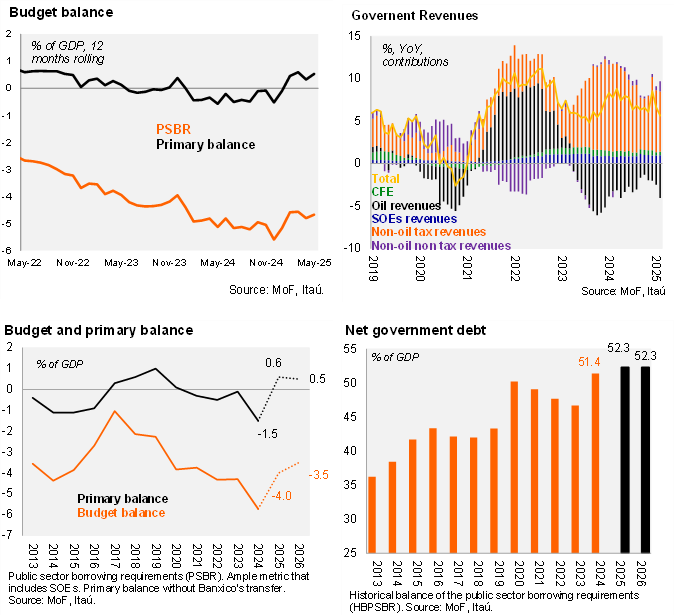

The Ministry of Finance (MoF) released its public finance report for May. On a 12-month rolling basis, the broadest measure of the public balance (PSBR) posted a deficit of 4.7% of GDP as of May, while the primary public balance showed a surplus of 0.5% of GDP. This result was mainly due to a 5.3% YoY real contraction in total expenditure, primarily from lower capital investment, despite a 5.1% YoY real growth in pensions. On the income side, real revenues rose by 3.7% YoY, supported by higher-than-expected import tax and VAT revenues, despite a significant contraction in Pemex oil revenues amid decreasing oil production. Finally, net government debt stood at 49.2% of GDP, below the MoF’s 2025 forecast of 52.3%.

Our view: May figures showed that revenues continued to grow, although at a slower pace than in April. Expenditures declined, reaching 94.3% of the budget for the period, with the reduction driven primarily by cuts to public investment. For 2025, we anticipate fiscal consolidation with a nominal deficit of 4.0%, a rising net government debt of 52.3%, and a positive primary balance of 0.6%, in a context of lower interest payments compared to the previous year. We think that despite some tailwinds for revenues, such as increased use of technology in customs and higher taxes on products from countries without a trade agreement with Mexico, more revenue-enhancing measures may be needed in 2026.

See more details below